1

How the New SAVE Plan Will Transform Loan Repayment

and Protect Borrowers

The Biden-Harris Administration believes that education beyond high school should unlock doors to

opportunity, not leave borrowers stranded with debt they cannot afford. That’s why from day one we

have been working to fix the broken student loan system, make college more affordable, and strengthen

oversight and accountability of postsecondary institutions.

Today, the U.S. Department of Education (Department) released final regulations on its new income-

driven repayment (IDR) plan, which will provide student loan borrowers with the most affordable

repayment plan ever. The SAVE plan will cut payments on undergraduate loans in half compared to

other IDR plans, ensure that borrowers never see their balance grow as long as they keep up with their

required payments, and protect more of a borrower’s income for basic needs. Under the Saving on a

Valuable Education (SAVE) plan, a single borrower who makes less than $15 an hour will not have to

make any payments.

1

Borrowers earning above that amount would save more than $1,000 a year on

their payments compared to other IDR plans.

The SAVE plan, which is available to student borrowers with a Direct Loan in good standing, will replace

the existing Revised Pay-As-You-Earn (REPAYE) plan which is the most generous existing IDR plan for

most borrowers. Borrowers who are already on the REPAYE plan will be automatically enrolled in the

SAVE plan and see their payments automatically adjust with no action on their part. While the

Department makes this transition, borrowers may see the names REPAYE and SAVE used

interchangeably. Borrowers can sign up for the SAVE/REPAYE plan today by visiting StudentAid.gov/IDR

.

By law, the regulations will go fully into effect on July 1, 2024. But the Department will implement three

critical benefits this summer before the student loan payment pause ends:

• The amount of income protected from payments on the SAVE plan will rise from 150 percent to

225 percent of the Federal poverty guidelines (FPL). This change means a single borrower who

earns less than $32,805 a year ($67,500 for a family of four) will not have to make payments. As

a result, we estimate that more than 1 million additional low-income borrowers will qualify for a

$0 payment, including 400,000 who are already enrolled on the REPAYE plan and will see this

benefit applied automatically. This will allow them to focus on food, rent, and other basic needs

instead of loan payments. Borrowers not eligible for a $0 payment will save at least $1,000 a

year compared to the current REPAYE plan. A single borrower would save $91 a month on

payments ($1,080 a year), while a family of four would save $187 ($2,244 a year).

• The Department will stop charging any monthly interest not covered by the borrower’s payment

on the SAVE plan. As a result, borrowers who pay what they owe on this plan will no longer see

their loans grow due to unpaid interest. We estimate that 70 percent of borrowers who were on

IDR plan before the payment pause would stand to benefit from this change.

• Married borrowers who file their taxes separately will no longer be required to include their

spouse’s income in their payment calculation for SAVE. These borrowers will also have their

spouse excluded from their family size when calculating IDR payments, simplifying the choice of

repayment plan for borrowers.

2

Borrowers will see the following additional benefits that reduce monthly and lifetime payments when

the SAVE plan is fully implemented next July:

• Payments on undergraduate loans will be cut in half (from 10% to 5% of incomes above 225% of

FPL). Borrowers who have undergraduate and graduate loans will pay a weighted average of

between 5% and 10% of their income based upon the original principal balances of their loans.

2

For example, a single undergraduate borrower making $50,000 a year would see their payments

fall a further $72 a month, bringing their total reduction on the SAVE plan to $163 a month.

• Borrowers whose original principal balances were $12,000 or less will receive forgiveness after

120 payments (the equivalent of 10 years in repayment), with an additional 12 payments added

for each additional $1,000 borrowed above that level, up to a maximum of 20 or 25 years.

Current IDR plans require all borrowers, even those who only attended school for a single term,

to repay their loans for at least 20 or 25 years before receiving forgiveness of any outstanding

balance. This change will make IDR a more attractive option for borrowers who would otherwise

struggle the most to repay their loans, including those with low balances and those who left

college before completing their program.

Additionally, the final rule will make it easier for borrowers to navigate repayment by eliminating

common pitfalls to forgiveness and protecting at risk borrowers. This includes the following changes,

which will take effect when the rule is fully implemented:

• Borrowers who go 75 days without making a payment will be automatically enrolled in the SAVE

plan if they have previously provided approval for the disclosure of their Federal tax information

to the Department.

• Borrowers in default will gain access to the existing income-based repayment (IBR) plan,

allowing them to access lower payments and accumulate progress toward forgiveness while

they work to exit default. Borrowers in default who provide income information that shows they

would have had a $0 payment at the time of default will be automatically moved to good

standing, allowing them to access the SAVE plan.

• Borrowers will receive credit toward forgiveness on certain deferments including those related

to unemployment, cancer treatment, and military service. Going forward, borrowers will also

receive credit for certain forbearances such as those related to natural disasters. This will

eliminate many common pitfalls that can make it harder for borrowers to successfully navigate

repayment.

• Borrowers who end up in a deferment or forbearance that is not counted toward forgiveness

(other than in-school deferment) will have up to three years to make additional payments based

upon their current IDR payment to receive credit toward forgiveness for those periods.

• Borrowers will receive credit for payments made prior to a consolidation based upon a weighted

average of the principal balances in the loans being consolidated rather than having their

progress toward forgiveness reset.

Estimated effects of the SAVE Plan

The benefits of the SAVE plan will be particularly critical for low- and middle-income borrowers,

community college students, and borrowers who work in public service. Overall, the Department

estimates

3

that the plan will have the following effects for future cohorts of borrowers compared to the

existing REPAYE plan:

3

• Borrowers will see their total payments per dollar borrowed fall by 40%.

4

Borrowers with the

lowest projected lifetime earnings will see payments per dollar borrowed fall by 83%, while

those in the top would only see a 5% reduction.

5

• A typical graduate of a four-year public university will save nearly $2,000 a year.

6

• A first-year teacher with a bachelor’s degree will see a two-third reduction in total payments,

saving more than $17,000, while pursuing Public Service Loan Forgiveness.

7

• 85% of community college borrowers will be debt-free within 10 years.

8

• On average, Black, Hispanic, American Indian and Alaska Native borrowers will see their total

lifetime payments per dollar borrowed cut in half.

Building on an Unparalleled Record of Debt Relief

The final regulations build upon the work the Biden-Harris Administration has already done to improve

the student loan program, make higher education more affordable, and approve targeted relief for 2.2

million student loan borrowers. These regulations also build on the Administration’s commitment to

ensuring IDR plans deliver relief to eligible borrowers through a one-time payment count adjustment

.

The Biden-Harris Administration remains committed to making college more affordable and ensuring

student debt isn’t a roadblock in accessing education or opportunities. Our Administration has made the

largest increase to Pell Grants in a decade and has proposed to double the maximum Pell Grant and

make community college free to reduce the need for students to take out unaffordable debt in the first

place. Our Administration is also holding institutions accountable for unaffordable debts, and recently

proposed regulations that would set standards for earnings and debt outcomes for career programs

while enhancing transparency for all programs to give students the information they need to make

informed choices.

View an unofficial copy of the final IDR regulation here

.

4

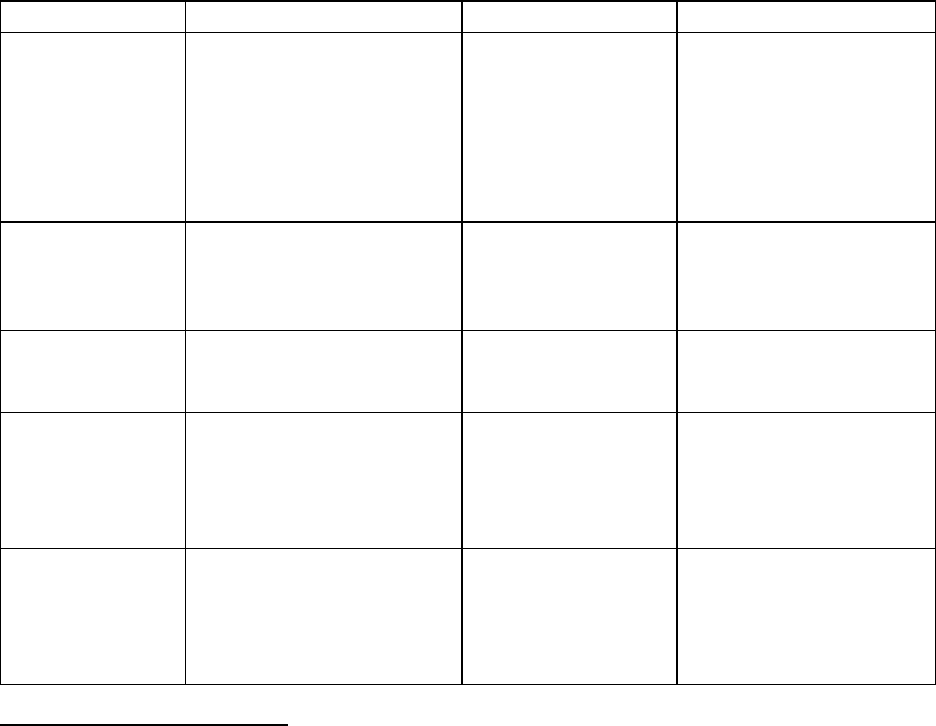

Comparing IDR plans

The table below shows how the SAVE plan, once fully implemented, compares to existing IDR plans.

Plan

Payment terms

Forgiveness time

Effect of Final Rule

Saving on a

Valuable

Education (SAVE)

5% of discretionary income

for undergraduate loans,

10% for graduate loans, and

a weighted average for

borrowers who have both.

10 years for low-

balance borrowers

(<$12,000), 20 years

for only

undergraduate loans,

and 25 years for any

graduate loans.

Transforms terms of

REPAYE.

Revised Pay As

You Earn

(REPAYE)

10% of discretionary income

20 years for only

undergraduate loans

and 25 years for any

graduate loans.

Transformed into SAVE.

Pay As You Earn

(PAYE)

10% of discretionary income,

up to the standard 10-year

payment amount

20 years.

No new enrollments.

Income-Based

Repayment (IBR)

10% of discretionary income,

up to the standard 10-year

payment amount. Borrowers

before 2014 pay 15% of

discretionary income.

20 years. Borrowers

before 2014 pay for

25 years.

Remains available, but

borrowers cannot select

after 60 payments on

REPAYE that occur on or

after July 1, 2024.

Income-

Contingent

Repayment (ICR)

The lesser of: 20% of

discretionary income and 12

-

year repayment amount

multiplied by an income

percentage factor.

25 years.

No new enrollments for

students. Available only to

future borrowers with

consolidated Parent PLUS.

1

Assumes annual earnings of $15 an hour over 2,000 hours, which is $30,000.

2

For example, a borrower with $20,000 from their undergraduate education and $60,000 from graduate school

pays 8.75 percent of their income. The formula is (25% x 5%) + (75% x 10%) = 8.75%.

3

These projections compare total payments per dollar borrowed if all future borrowers in a given cohort were to

enroll in REPAYE compared to total payments if all borrowers were to enroll in SAVE, based on models of

borrowers’ employment, income, marriage (including spousal income and debt), and family size over the lifetime

of repayment.

4

Lifetime payments equal the present discounted value of total payments until the loan is repaid or forgiven and

are expressed on a per dollar borrowed basis to make it easier to compare potential savings across borrowers that

may borrow different amounts.

5

Borrowers in the bottom 30 percent of lifetime earnings are in families with earnings less than $29,000, on

average In their first 10 years of repayment, while borrowers in the top 30 percent of lifetime earnings are in

families with earnings exceeding $90,000, on average.

6

This assumes that the borrower is earning $50,000 per year after graduating.

7

This assumes typical debt of $24,425 (the average debt in bachelor’s degree in education programs, according to

the College Scorecard), and a starting salary of $43,596 with annual increases of 1.5% per year, both of which are

from Table 211.20 in the Digest of Education Statistics. Salary and debt are adjusted for inflation using CPI-U to

reflect 2020 dollars.

8

This example is based on the borrowing patterns and amounts of recent cohorts.