Year-end

considerations

Financial services sector

supplement

May 2023

The year 2022 was full of disruptive factors such as high ination, Ukraine and Russia war, interest rate

volatility, events in crypto market etc., due to which there has been a major impact on the BFSI (Banking,

Financial services, and Insurance) sector. The year 2023 has kickstarted with a few major events, such as

failure of few global nancial institutions, which has increased the fear of global nancial crises. In light

of these events, governments, and central banks all over the world have become more vigilant, especially

in the areas of governance and controls.

There have been various regulatory developments/amendments during the year to ensure that entities in

the nancial service sector are operating efciently. The idea is to adopt high standards of governance in

a globally competitive manner. There are several amendments around new accounting framework such

as expected credit loss, scale-based regulation for NBFCs, IFRS 17 for Insurance companies, Ind AS for

mutual funds etc.

It is our constant endeavor to help entities stay updated with latest developments and changes in nance

function. As all entities gear-up to nalize their nancial statements for the year-ended 31 March 2023,

it is critical that they evaluate all key changes in accounting and regulatory space which impacts nancial

and corporate reporting. This publication provides critical updates and insights to help nance leaders

and teams update themselves with the changes applicable for the year-end closure and ensure that the

companies are well prepared for the closure with the changes.

Purpose of this publication

This publication is the nancial services sector supplement of our year-end reporting considerations

publication which provides an overview of the changes in accounting standards and interpretations as

well as regulatory changes up to 31 January 2023 which are relevant for nancial year (FY) 2022-

23 and beyond. It covers key changes which are relevant to the BFSI sector and provides a glance at

the regulatory and other changes that have been issued during this year, which have consequential

impact on accounting, disclosures, and compliance with regulations. It does not attempt to cover all the

regulatory pronouncements but covers the key changes impacting the nancial year-ended 31 March

2023. This publication does not aim to provide an in-depth analysis or discussion on the changes,

rather it aims to highlight the key aspects of these changes. Reference should be made to the text of the

pronouncements before taking any decisions or actions.

The publication is divided into the following sections:

Section 1: Banks and NBFCs

Section 2: Insurance

Section 3: Wealth and Asset Management

Hope you all nd the publication useful.

Foreword

Adarsh Ranka

Financial Accounting Advisory Services Leader,

Partner with an Indian member rm of EY Global

Table of

contents

Section 1: Banks and NBFCs

Section 2: Insurance

Section 3: Wealth and Asset Management

A. Impacting nancial statements

B. Other Regulatory changes

1. Reserve Bank of India (Financial Statements - Presentation and Disclosures) Directions, 2021

2. Reserve Bank of India (Unhedged Foreign Currency Exposure) (UFCE) Directions, 2022

3. Establishment of Digital Banking Units (DBUs)

4. Regulatory Restrictions on Loans and Advances

5. Disclosures in Financial Statements- notes to accounts of NBFCs

6. Provisioning requirement for investment in Security Receipts (SRs)

1. Discussion Paper (DP) on Expected credit loss Framework for Provisioning by Banks

2. Requirement of compliance function and role of Chief Compliance Ofcer (CCO)

3. Guidelines on Compensation of Key Managerial Personnel (KMP) and Senior Management in

NBFCs

4. Updates on scale-based regulations

5. Guidelines on digital lending

6. Discussion Paper (DP) on Securitisation of Stressed Assets Framework (SSAF) –

applicable to all Banks and NBFCs

7. Review of regulatory framework for Asset Reconstruction Companies (ARCs)

8. Some of the key master directions which are updated by the RBI during the FY 2022-23

Section 1

Banks and NBFCs

Impacting

nancial statements

1. Reserve Bank of India (Financial Statements - Presentation and

Disclosures) Directions, 2021

2. Reserve Bank of India (Unhedged Foreign Currency Exposure) (UFCE)

Directions, 2022

3. Establishment of Digital Banking Units (DBUs)

4. Regulatory Restrictions on Loans and Advances

5. Disclosures in Financial Statements- notes to accounts of NBFCs

6. Provisioning requirement for investment in Security Receipts (SRs)

A

5

Financial Services Sector supplement

RBI had issued Master Direction on Financial Statements

- Presentation and Disclosures vide direction dated 30

August 2021. Subsequent to this, Reserve Bank of India

(RBI) has issued some clarication and has updated the

master direction during FY 2022-2023. This master

direction contains the format of Balance Sheet and Prot

and Loss Account, notes and instructions for compilation,

disclosures in notes to accounts and instructions and

format for the consolidated nancial statements. Apart

from nancial statements presentation and disclosures, this

master direction also includes other instructions such as

inter branch account provisioning, reconciliation of nostro

accounts, maintenance of reserve fund and deferred tax

liability on special reserve. Following are the key updates

that were issued by the RBI during the FY 2022-23:

Reporting of reverse repos with Reserve

Bank on the bank’s balance sheet

Disclosure of Divergence in Asset

Classication and Provisioning

1

Reserve Bank of India (Financial Statements - Presentation and

Disclosures) Directions, 2021

In order to bring more clarity on the presentation of reverse

repo on Bank’s balance sheet, RBI issued clarications on

reverse repo transactions dated 19 May 2022. As per

these guidelines, banks are required to report reverse repos

in their balance sheet as follows:

•

All type of reverse repos with the Reserve Bank

including those under Liquidity Adjustment Facility shall

be presented under sub-item (ii) ‘In Other Accounts’ of

item (II) ‘Balances with Reserve Bank of India’ under

Schedule 6 ‘Cash and balances with Reserve Bank of

India’.

•

Reverse repos with banks and other institutions having

original tenors up to and inclusive of 14 days shall be

classied under item (ii) ‘Money at call and short notice’

under Schedule 7 ‘Balances with banks and money at

call and short notice’.

•

Reverse repos with banks and other institutions having

original tenors more than 14 days shall be classied

under Schedule 9 – ‘Advances’ under the following

heads:

•

A. (ii) ‘Cash credits, overdrafts and loans repayable

on demand’

•

B. (i) ‘Secured by tangible assets’

•

C. (I).(iii) Banks (iv) ‘Others’ (as the case may be)

In terms of paragraph C.4(e) of Annexure III to

the Reserve Bank of India (Financial Statements

- Presentation and Disclosures) Directions, 2021,

commercial banks (excluding Regional Rural Banks

(RRBs)) are required to disclose details of divergence

in asset classication and provisioning where such

divergence assessed by the RBI exceeds certain specied

thresholds. In order to strengthen compliance with

income recognition, asset classication and provisioning

norms, RBI has revised the specied thresholds for

commercial banks and introduced similar disclosure

requirements for Primary (Urban) Co-operative Banks

(UCBs).

Accordingly, for the nancial statements for the year

ending 31 March 2023, banks shall make suitable

disclosures in the manner specied in paragraph C.4(e) of

Annex III to the afore-mentioned Directions, if either or

both of the following conditions are satised:

i. the additional provisioning for non-performing assets

(NPAs) assessed by the RBI exceeds 10% of the

reported prot before provisions and contingencies

for the reference period; and

ii. the additional Gross NPAs identied by the RBI exceed

10% of the reported incremental Gross NPAs for the

reference period.

Provided further that in the case of UCBs, the threshold

for reported incremental Gross NPAs specied in

paragraph (ii) above shall be 15%, which shall be reduced

progressively in a phased manner, after review.

The thresholds specied in above shall be revised for

disclosures in annual nancial statements for the year

ending 31 March 2024, and onwards, as under:

*May be reduced subject to review

I

II

How we see it: The main objective of the above

notication is to bring clarity to the presentation

of reverse repo on the Balance sheet. Prior to this

notication, there was a mixed practice followed by

Banks to present balance in Reverse Repo Account

under Schedule 7 (Balance with Banks and Money

at Call & Short Notice) or Schedule 9 (Advances).

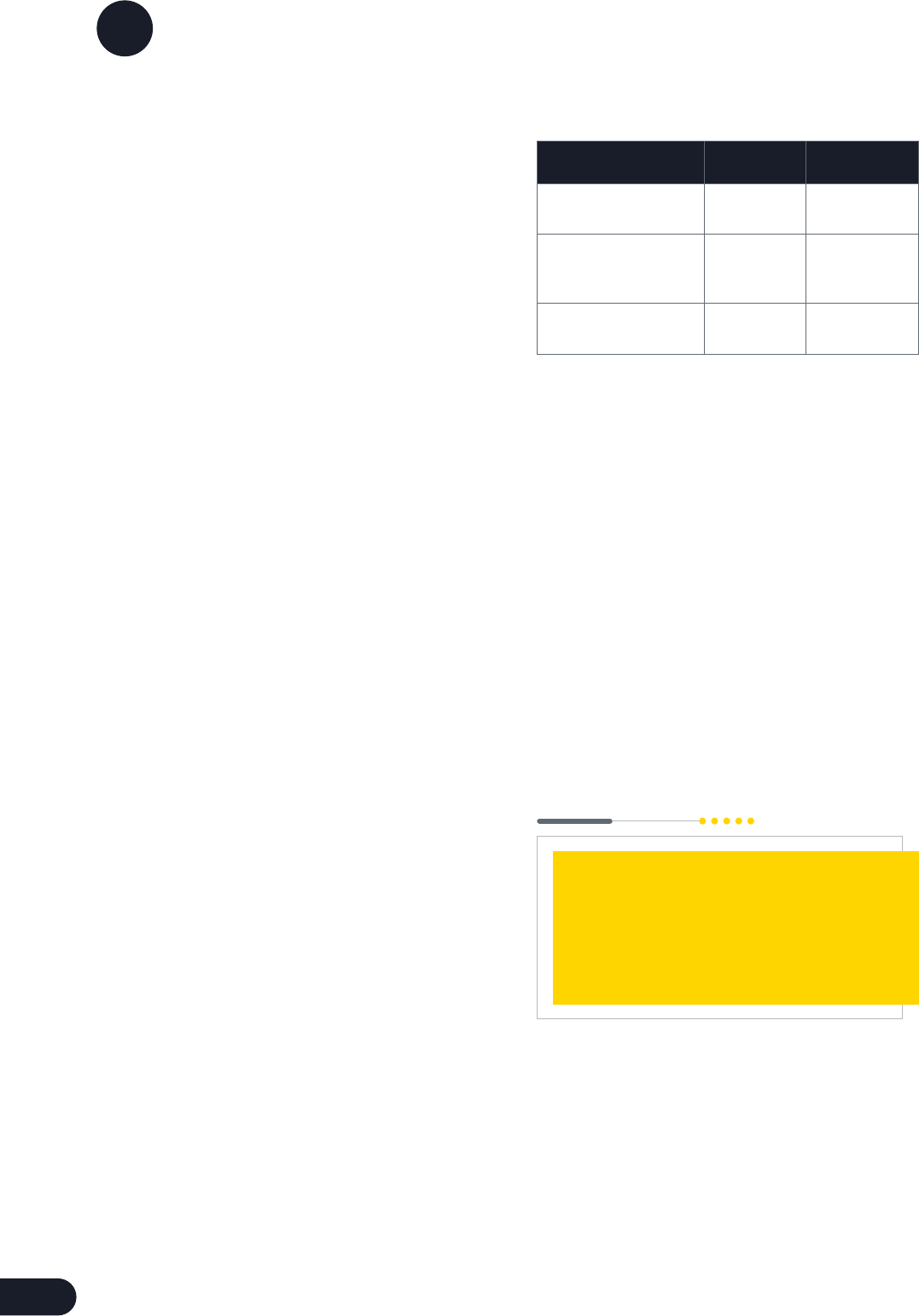

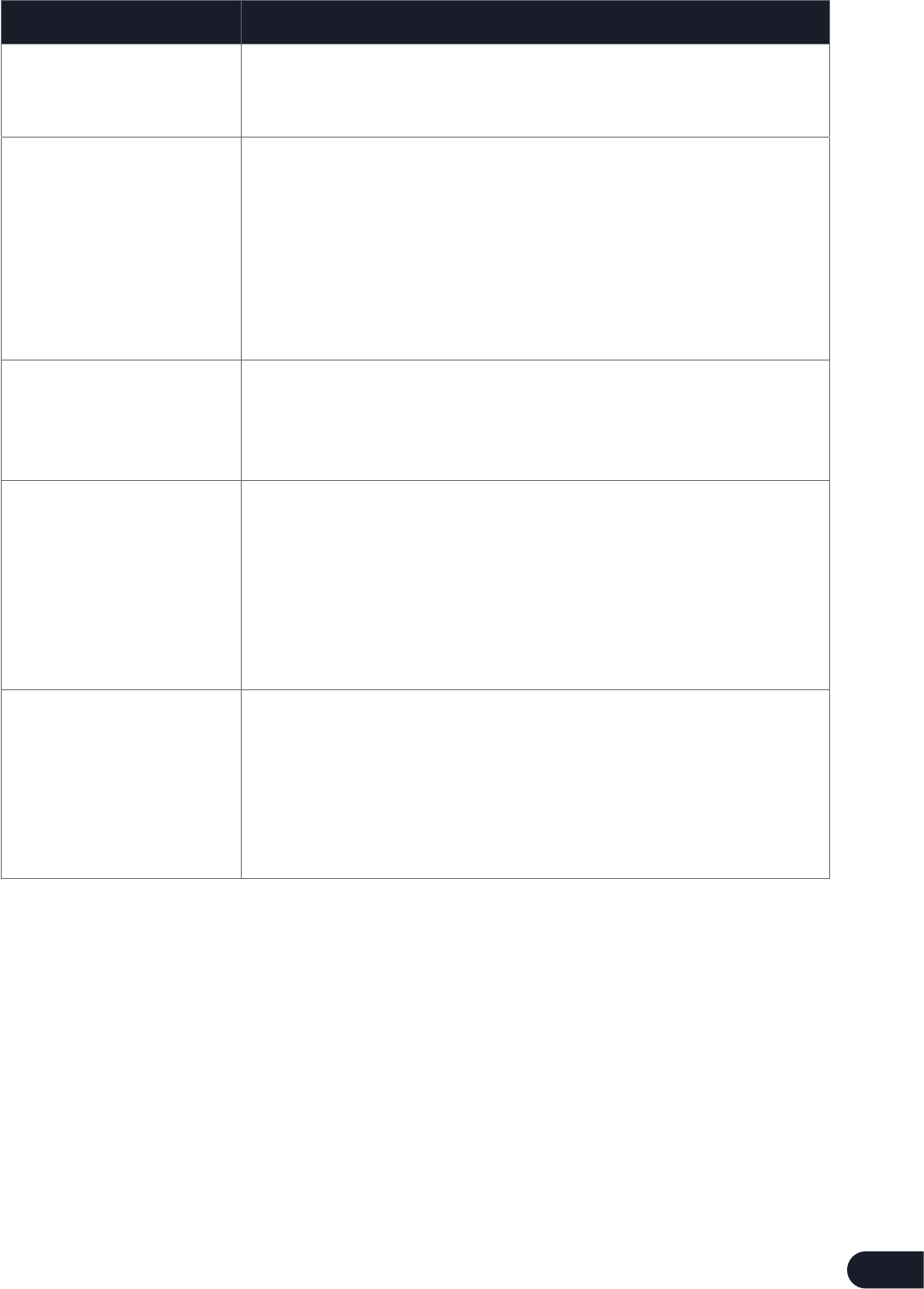

Ref. Threshold linked to

Commercial

Banks (%)

UCBs (%)

(i)

Reported prot

before provisions and

contingencies

5 5

(ii)

Reported incremental

Gross NPA

5 15*

6

Financial Services Sector supplement

How we see it: It seems that the RBI’s intention

is to tighten the disclosure norms around the

divergence of NPA assets. Divergence takes

place when the RBI nds that a lender has under-

reported (or not reported at all) bad loans in a

particular year.

Earlier, the commercial banks (excluding RRBs)

were required to disclose details of divergence

in asset classication and provisioning where

such divergence assessed by the RBI exceeds

certain specied thresholds (10% of the reported

prot before provisions and contingencies for

the reference period and additional Gross NPAs

identied by RBI exceeds 15% of the published

incremental Gross NPAs).

Now, RBI mandated similar disclosure requirements

for UCBs also and revised the specied thresholds

for commercial banks.

How we see it: The above notication is aimed

at enhancing transparency in a bank’s nancial

statements through detailed disclosures. The banks

will have to ensure that the necessary data for

the above-mentioned disclosure is appropriately

available and presented in a manner that aids in

better understanding of the nancial position and

performance of the banks.

Disclosure of material items

In terms of Part A of Annexure II to the mentioned

Directions, in case any item under the subhead

“Miscellaneous Income” under the head “Schedule

14-Other Income” exceeds 1% of total income,

particulars shall be given in the notes to accounts.

Similar instructions exist in the case of subhead “Other

expenditure” under the head “Schedule 16-Operating

Expenses” where particulars shall be given in the notes to

accounts for other expenditure exceeding 1% of the total

income.

Payments bank shall disclose particulars of all the items

under the Schedule 14(I)-Other Income-“Commission,

Exchange and Brokerage” that exceeds 1% of the total

income in the notes to accounts.

In order to ensure greater transparency, banks shall also

disclose the particulars of all such items in the notes

to accounts wherever any item under the Schedule

5(IV)-Other Liabilities and Provisions-“Others (including

provisions)” or Schedule 11(VI)-Other Assets-“Others”

exceeds 1% of the total assets. These instructions are

applicable to all commercial banks. These instructions

shall come into effect for disclosures in the notes to the

annual nancial statements for the year ending 31 March

2023 and onwards.

III

7

Financial Services Sector supplement

2

Reserve Bank of India (Unhedged Foreign Currency Exposure) (UFCE)

Directions, 2022

This circular is applicable to all commercial banks

(excluding Payments Banks and RRBs) and the overseas

branches / subsidiaries of banks incorporated in India.

These instructions shall come into force from 01 January

2023.

To address the risk on bank’s books, banks were advised

to maintain incremental provisioning and capital

requirements for their exposures to entities with UFCE.

The process of computing incremental provisioning and

capital requirements can be summarized in the following

steps:

•

Step 1: Assess the foreign currency exposure (FCE) of

the entity.

•

Step 2: Ascertain the amount of UFCE from entities’

FCE, taking into account two types of hedges – natural

hedge and nancial hedge.

•

Step 3: Estimate the potential loss to the entity

from UFCE exposure to entity due to exchange rate

movements.

•

Step 4: Maintain incremental provisioning and capital

requirements against banks’ exposure to the entity

based on the impact of likely / potential loss on

entity’s overall protability.

Computation of Unhedged Foreign Currency Exposure:

a. Banks should ascertain the Foreign Currency Exposure

(FCE) from all sources, including the foreign currency

borrowings and external commercial borrowings of

all entities at least on an annual basis. Banks shall

compute the FCE following the relevant accounting

standard applicable to the entity. Banks shall consider

the items maturing or having cash ows over the

period of next ve years.

b. Banks should assess the UFCE of entities with FCE by

obtaining information on UFCE from the concerned

entity. Information on UFCE shall be obtained from

entities on a quarterly basis based on statutory audit,

internal audit, or self-declaration by the concerned

entity. UFCE information shall be audited and certied

by the statutory auditors of the entity, at least on an

annual basis.

Provisioning and Capital Requirements

a. The largest annual volatility in the USD-INR exchange

rates during the last 10 years should be used to

determine the potential loss to an entity from UFCE.

For other than the US currency UFCE, it should be

converted to US dollar using current market rates for

determining potential loss.

b. Susceptibility of the entity to adverse exchange rate

movements should be determined by computing the

ratio of the potential loss to the entity from UFCE and

the entity’s Earnings Before Interest and Depreciation

(EBID) over the last four quarters as per the latest

quarterly results certied by the statutory auditors.

•

In cases where banks are not in position to obtain

information on UFCE or EBID from listed entities for

the latest quarter due to restrictions on disclosure

of such information prior to nalization of accounts,

banks shall have the option to use data pertaining to

the immediately preceding last four quarters.

•

In case of unlisted entities where the audited results

of the last quarter are not available, the latest audited

quarterly or annual results available shall be used.

The annual EBID gure used shall at least be of the

last nancial year.

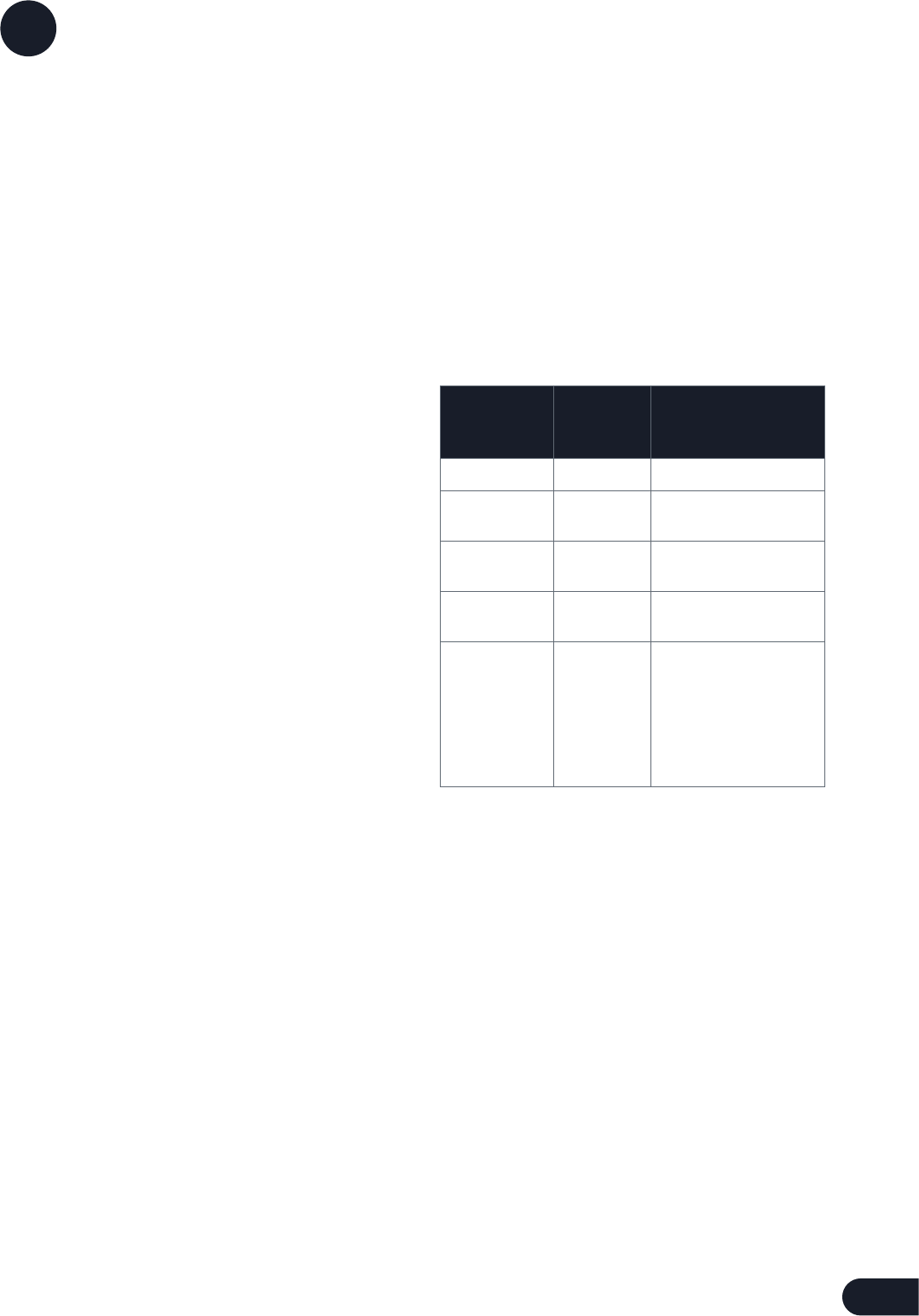

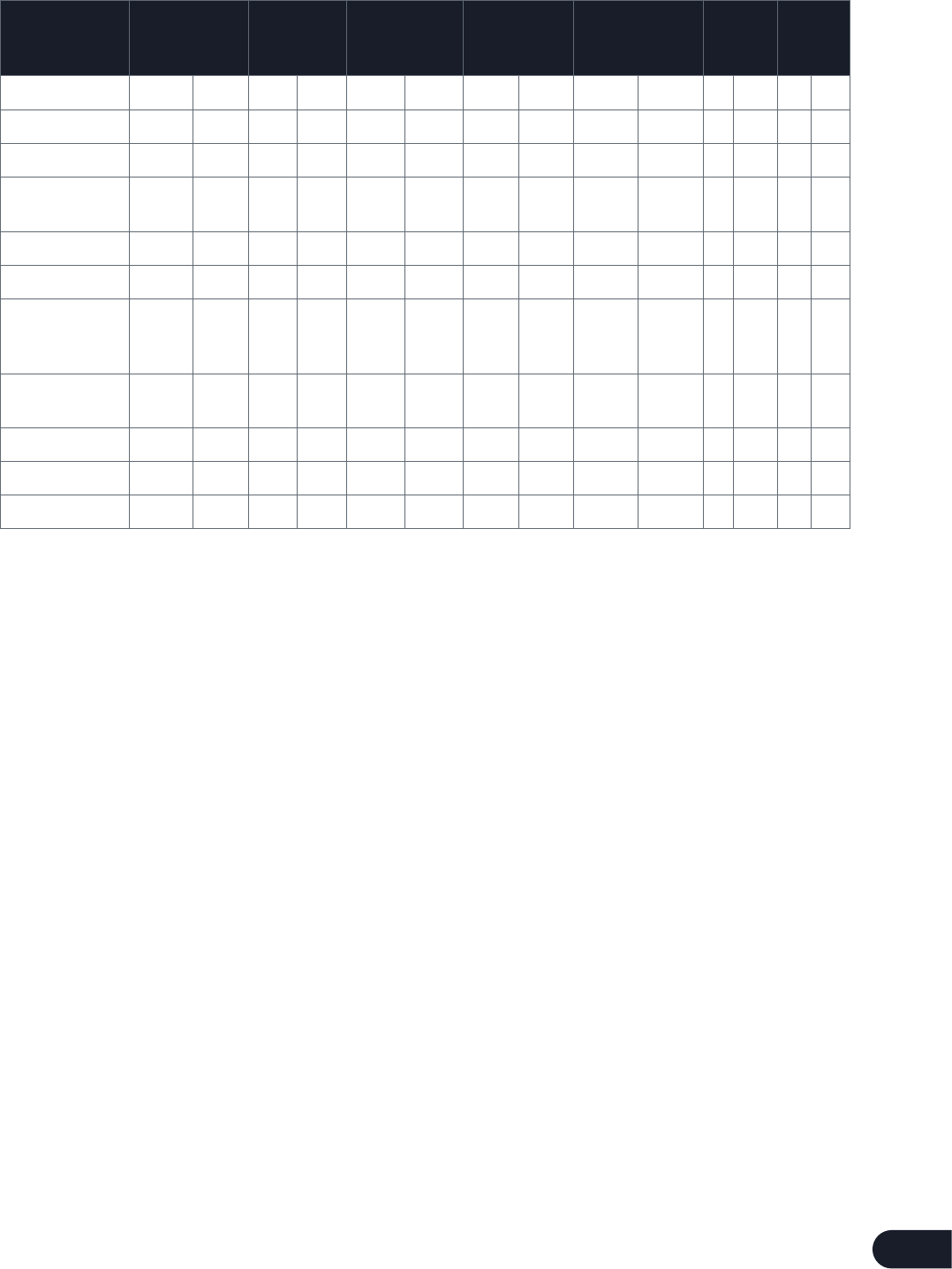

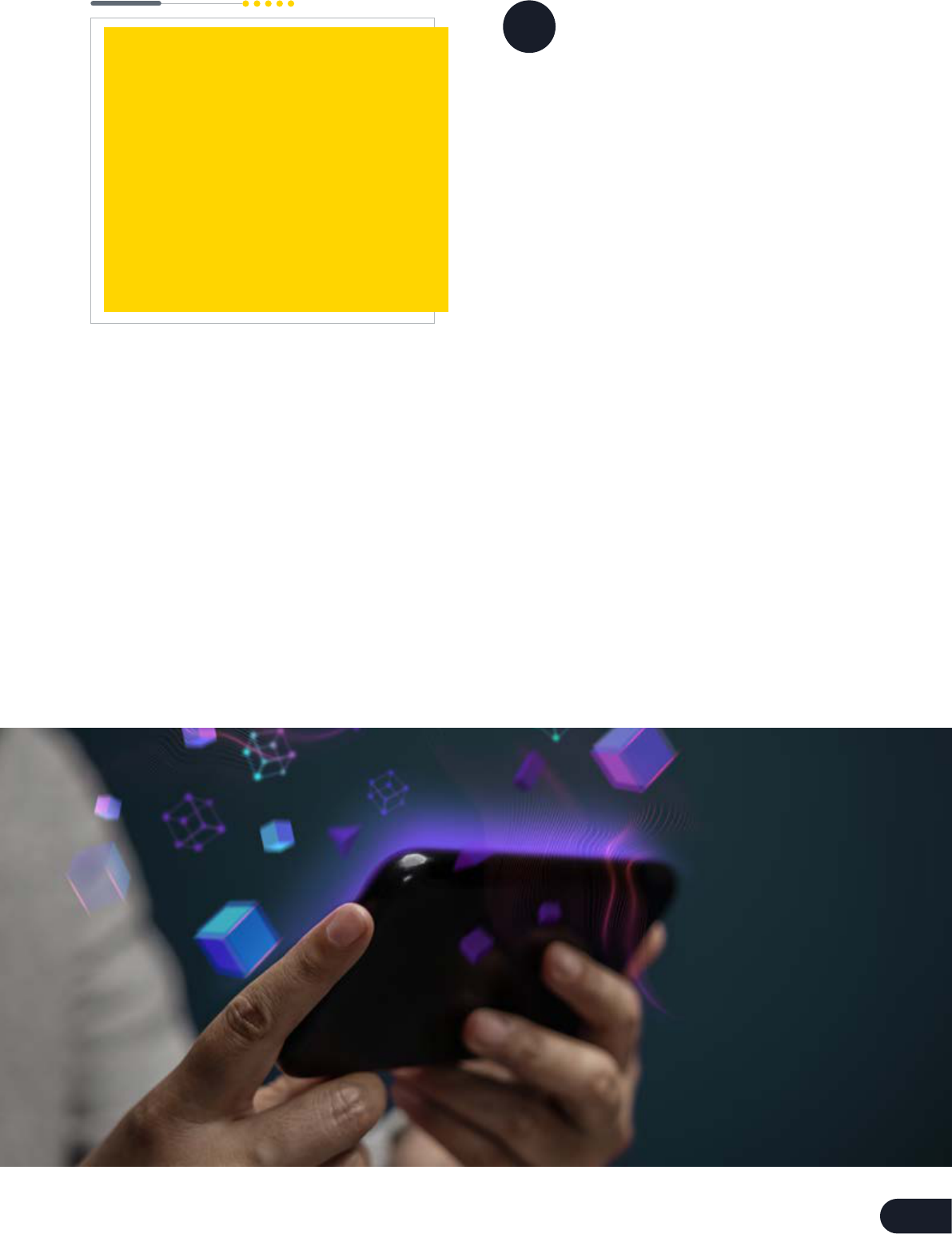

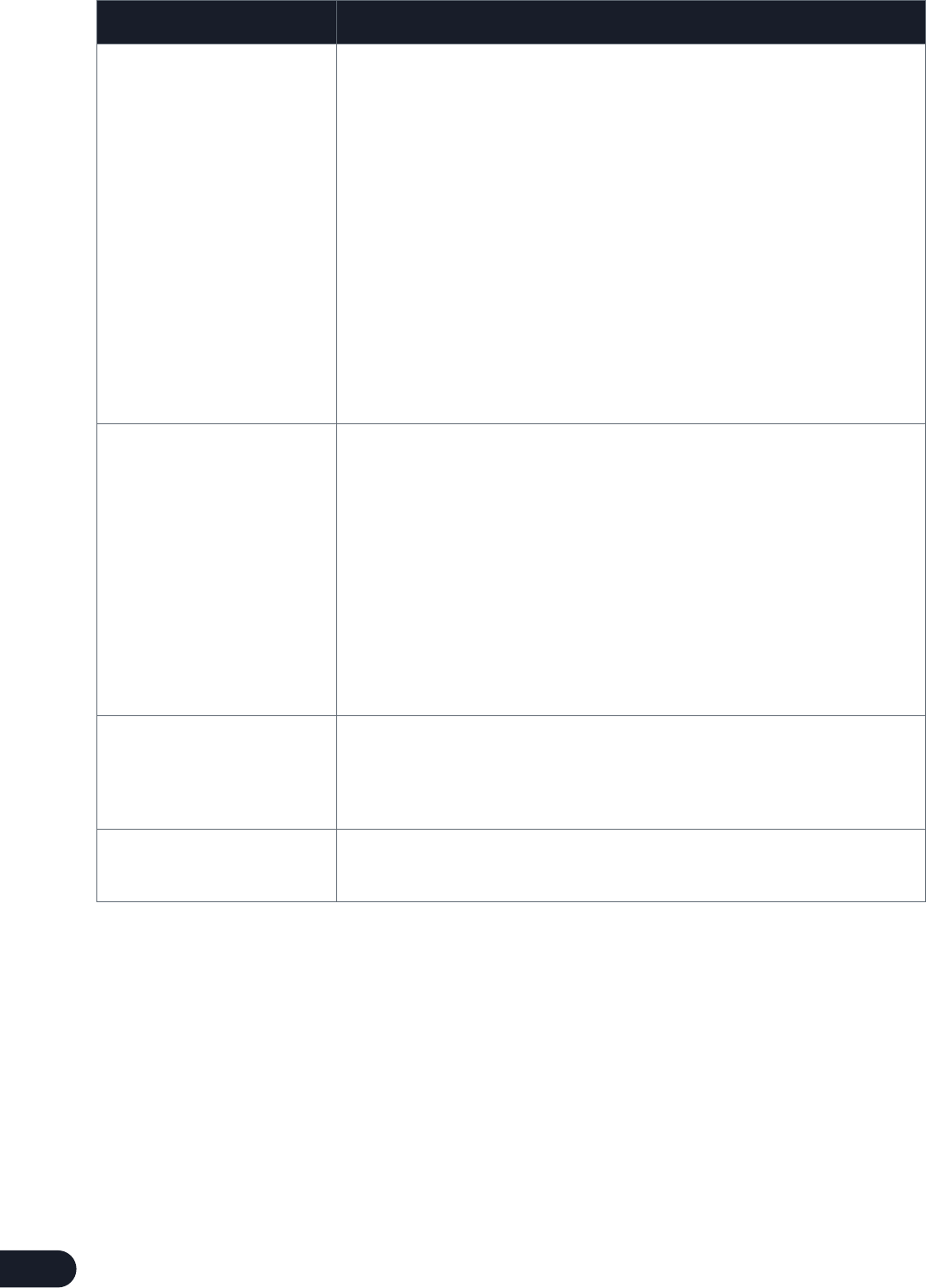

c. Banks shall apply incremental capital and provisioning

requirements to all exposures to such entities as under:

Potential loss/

EBID (%)

Incremental

provisioning

requirement

Incremental capital

requirement

Up to 15 % 0 0

More than 15%

and up to 30%

20bps 0

More than 30%

and up to 50%

40bps 0

More than 50%

and up to 75%

60bps 0

More than 75 % 80 bps 25% point increase in

the risk weigh

(For example: for an entity

which otherwise attracts

a risk weight of 50%, the

applicable risk weight

would become 75%)

The incremental provisioning for UFCE shall be based on

the total exposure amount which is used for computing

standard asset provisioning and incremental capital

requirements for UFCE shall be based on the total

exposure amount which is used for computing credit risk

capital requirements.

d. Banks shall calculate the incremental provisioning

and capital requirements at a minimum on a quarterly

basis.

e. For projects under implementation and the new

entities, Banks shall calculate the incremental

provisioning and capital requirements based on

projected average annual EBID for the three years

from the date of commencement of commercial

operations. This provisioning should be subjected to a

minimum oor of 20 bps of provisioning requirement.

8

Financial Services Sector supplement

f. In cases where the bank is not able to get sufcient

data to assess UFCE and compute incremental

capital and provisioning requirements except for the

smaller entities covered under the alternative method

provided in sub-clause (g) below, the bank shall take

a conservative view and place the exposure to the

entity at the last bucket which requires incremental

provisioning of 80bps and a 25%-point increase in risk

weight.

g. This alternative method is for smaller entities* which

are not in position to provide information, banks shall

apply an incremental provisioning of 10 bps over

and above extant standard asset provisioning instead

of computing incremental capital and provisioning

requirements

*Smaller entities are those entities on which total

exposure of the banking system is at INR 50 crore or

less.

Systems and Controls:

•

Banks shall incorporate the risk of UFCE of entities

in their internal credit rating system and credit risk

management policies and procedures.

•

Internal limits shall be stipulated for UFCE within the

overall Board approved risk policy of the bank.

Consortium Lending: In the case of consortium/

multiple banking arrangements, the consortium leader/

bank having the largest exposure shall have the lead

role in monitoring the UFCE of entities.

Note: Banks shall put in place a system for information

sharing and dissemination in terms of circular DBOD.

No.BP.BC.94/08.12.001/2008-2009 dated 08

December 2008, on ‘Lending under Consortium

Arrangement / Multiple Banking Arrangements’, as

amended from time to time.

Exemption / Relaxation: Banks shall have the option to

exclude the following exposures from the calculation of

UFCE:

•

Exposures to entities classied as sovereign, banks,

and individuals.

•

Exposures classied as NPA.

•

Intra-group foreign currency exposures of

Multinational Corporations (MNCs) incorporated

outside India.

if the bank is satised that such foreign currency

exposures are appropriately hedged or managed

robustly by the parent.

•

Exposures arising from derivative transactions and /

or factoring transactions with entities, provided such

entities have no other exposures to banks in India.

Capital Treatment and Disclosures: The incremental

provision requirement for UFCE shall be treated as a

general provision for disclosures and inclusion in Tier 2

capital.

Overseas Branches/Subsidiaries: The provisions

of these Directions shall be applicable to overseas

branches/subsidiaries of banks subject to the following:

•

With respect to the exposure to entities incorporated

outside India, information on UFCE shall be obtained

from such entities on a quarterly basis based on

internal audit or self-declaration and the requirement

of a certicate from statutory auditors on an annual

basis may not be insisted upon.

In cases where a bank is not able to obtain information

on UFCE from concerned entities, the treatment similar

to smaller entities shall apply.

•

Banks shall compute the potential loss due to UFCE

by replacing INR with the domestic currency of that

jurisdiction and US dollar with the foreign currency

(i.e., currency other than domestic currency of

that jurisdiction) in which the entity has maximum

exposure.

Banks shall compute the largest annual volatility over a

period of last 10 years considering: First, daily changes

in the foreign exchange rates shall be computed as

a log return of today’s rate over the previous day’s

rate. Second, daily volatility shall be computed as

standard deviation of these returns over a period of

one year (250 observations). Third, this daily volatility

shall be annualised by multiplying it by square root of

250. This computation shall be performed on a daily

basis for all the days in the last 10 years. The largest

annual volatility thus computed shall be used for the

computation of the potential loss by multiplying it with

the UFCE.

How we see it: Unhedged foreign currency

exposure of any entity is an area of concern not

only for the individual entity but also for the entire

nancial system. RBI has, from time to time, issued

several guidelines to the banks on UFCE of the

entities. In the current guidelines, the RBI has not

just consolidated all the necessary instructions

in one place but has also suggested certain key

changes around the denition of entity, exemption

from UFCE guidelines, incremental capital

requirement and alternative method for exposure

to small entities.

The RBI has provided a comprehensive set of

guidelines on UFCE, which requires that the Banks

make certain changes in their existing processes

and systems to be compliant with the guidelines.

9

Financial Services Sector supplement

How we see it: The DBUs of the banks will be

treated as banking outlets. It will enable customers

to have cost effective, convenient access and

enhanced digital experience of banking products

and services throughout the year. The DBUs will

have to adhere to various operational as well as

governance requirements.

3

Establishment of Digital Banking Units (DBUs)

RBI issued guidelines on the establishment of Digital

Banking Units (DBUs) on 07 April 2022. These

guidelines are applicable to all Domestic Scheduled

Commercial Banks (excluding RRBs, Payments Banks,

and Local Area Banks). Scheduled Commercial Banks

(excluding RRBs, Payments Banks, and Local Area

Banks) with past digital banking experience are

permitted to open DBUs in Tier 1 to Tier 6 centres,

unless otherwise specically restricted, without any

permission from the RBI. The DBUs of the banks will be

treated as Banking Outlets (BOs). Each DBU must offer

certain minimum digital banking products and services.

Such products should be on both liabilities and assets

side of the balance sheet of the digital banking segment.

There are various compliance considerations to

be taken care by these DBUs, such as offering

products and operational processes that are

regulatory complaint, having appropriate outsourcing

arrangements, risk monitoring, put in place adequate

digital mechanism for customer grievances, reporting

and disclosure requirements.

Banks shall report the Digital Banking Segment as

a sub-segment within the existing “Retail Banking

Segment” in the format as specied under paragraph

4 of Annexure II (Part B) of the Reserve Bank of India

(Financial Statements – Presentation and Disclosures)

Directions, 2021. It is claried that the digital banking

products / services applicable to segments other than

‘Retail Banking’ need not be reported at this stage.

Performance update with respect to DBU shall be

furnished in a pre-dened reporting format (being

separately issued) to Department of Supervision, RBI

on a monthly basis and in a consolidated form in Annual

Report of the bank.

10

Financial Services Sector supplement

4

Regulatory Restrictions on Loans and Advances

Guidelines applicable to NBFC - Upper Layer (UL) and

NBFC – Middle Layer (ML)

Loans and advances aggregating INR 5 crores and above

to Directors (including the Chairman/ Managing Director)

or relatives of Directors, including any rm/company in

which Director or their relatives are interested as partner,

manager, employer major shareholder, etc shall be

approved by Board of Directors/Committee of Directors of

such NBFCs.

Director or their relatives shall be deemed to be

interested in a company, being the subsidiary or holding

company, if he/she is a major shareholder or is in control

of the respective holding or subsidiary company.

Director who is directly or indirectly concerned or

interested in any proposal should disclose the nature

of her interest to the Board when any such proposal is

discussed and recuse from the meeting unless presence

is required by the other directors for the purpose of

eliciting information and the director so required to be

present shall not vote on any such proposal.

Board should be reported for the proposals for credit

facilities of an amount less than INR 5 crores to above

mentioned borrowers.

Loans and advances to Senior Ofcers of the NBFC

Loans and advances sanctioned to senior ofcers of the

NBFC shall be reported to the Board. No senior ofcer

nor as part of committee meeting shall, while exercising

powers of sanction of any credit facility, sanction any

credit facility to a relative of that senior ofcer. Such a

facility shall be sanctioned by the next higher sanctioning

authority under the delegation of powers.

For both categories of above loans (including contracts),

NBFCs shall obtain a declaration from the borrower

giving details of the relationship of the borrower to

their directors/ senior ofcers for loans and advances

aggregating INR 5 crores and above. NBFCs shall recall

the loan if it comes to their knowledge that the borrower

has given a false declaration.

The above restrictions do not apply to loans or advances

against:

•

Government securities

•

Life insurance policies

•

Fixed deposits

•

Stocks and shares

•

Housing loans, car advances, etc., granted to an

employee of the NBFC under any scheme applicable

generally to employees.

Current Year Previous Year

Directors and their

relatives

Entities associated

with directors and their

relatives

Senior Ofcers and

their relatives

Provided that NBFC’s interest/lien is appropriately

marked with legal enforceability.

(INR crores)

Following disclosure is required by NBFCs in their Annual

Financial Statement:

Loans and advances to real estate sector

While appraising loan proposals involving real estate,

NBFCs shall ensure that the borrowers have obtained

prior permission from government/ local government/

other statutory authorities for the project, wherever

required. Disbursement shall be made only after the

borrower has obtained requisite clearances.

Guidelines applicable to NBFC - Base Layer (BL) - Loans

to Directors, Senior Ofcers, and relatives of Directors

NBFCs shall have a Board approved policy which shall

include a threshold beyond which loans shall be reported

to the Board for grant of loans to directors, senior

ofcers, and relatives of directors and to entities where

directors or their relatives have major shareholding.

Similar disclosure (as mentioned in table above) shall be

provided in the annual nancial statements for such loans

and advances.

How we see it: The RBI circular has provided

detailed guidelines on restrictions on lending in

respect of NBFCs placed in different layers. NBFCs

should have the necessary process in place to

comply with such restrictions and ensure that

necessary disclosures are made in annual nancial

statement.

11

Financial Services Sector supplement

5

Disclosures in Financial Statements: notes to accounts of NBFCs

Currently, NBFCs are required to prepare their nancial

statements as per the following guidelines:

•

Format prescribed in Schedule III to the 2013

Act, as applicable and provides disclosures which

are mandated therein. Additionally, disclosure

requirements as per AS / Indian Accounting Standards

(Ind AS), as applicable to be followed.

•

NBFCs that are listed on a recognized stock exchange

in India are also required to comply with disclosure

requirements prescribed in the Securities and

Exchange Board of India (SEBI) Listing Regulations.

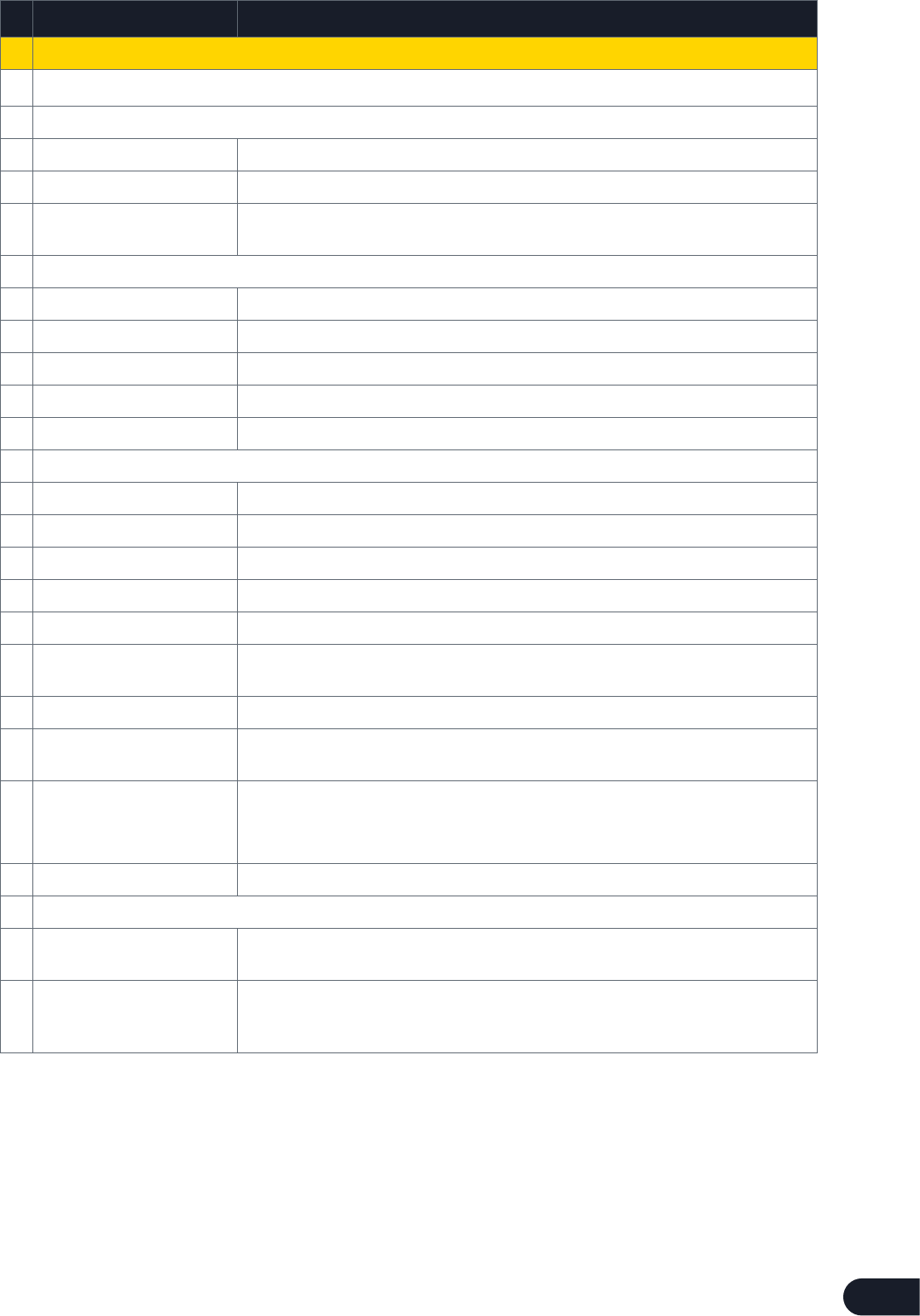

Disclosures Remarks

Exposure to real estate

sector

This is an existing disclosure requirement. This is applicable to all layers of NBFC

(Systemically Important non-deposit taking NBFCs and deposit taking NBFCs (SI-NBFCs)

and Housing Finance Company (HFCs)) and there is no change in the format of reporting.

Exposure to capital market Existing disclosure requirement is amended by RBI. Refer note 1 below

Sectoral exposure Existing disclosure requirement is amended by RBI. Refer note 2 below

Intra group exposures Existing disclosure requirement is amended by RBI. Refer note 3 below

Unhedged foreign

currency exposures

This is a new requirement under which NBFCs shall disclose details of its unhedged foreign

currency exposures and their policies to manage currency induced risk. Currently, NBFCs

provide disclosures of currency risk (or foreign exchange risk) arises on nancial instruments

that are denominated in a foreign currency, as per the disclosure requirements of Ind AS

107 : Financial Instruments.

Related party disclosure This is an existing disclosure and further new requirement is introduced. Refer note 4 below.

Currently, NBFCs provide disclosures of with respect to related party transactions as per the

requirements of Ind AS 24 : Related Party Disclosures.

Disclosure of complaints Existing disclosure requirement is amended by RBI. Refer note 5 below

Corporate governance This is a new requirement. Refer note 6 below. However, listed NBFCs are required to

comply with the disclosure requirements, as per SEBI - Listing Obligations and Disclosure

Requirements, Regulation 2015.

Breach of covenant This is a new requirement. NBFCs shall disclose all instances of breach of covenant of loan

availed or debt securities issued.

Divergence in asset

classication and

provisioning

This is an existing disclosure and further new requirement is introduced. Refer note 7 below

Disclosure of NBFCs – UL This is a new requirement. As per the SBR framework issued by Reserve Bank, NBFC-UL

shall be mandatorily listed within three years of identication as NBFC-UL. Upon being

identied as NBFC-UL, unlisted NBFC-ULs shall draw up a Board approved roadmap for

compliance with the disclosure requirements of a listed company under the SEBI (Listing

Obligations and Disclosure Requirements (LODR)) Regulations, 2015.

•

RBI has, from time-to-time, prescribed a set of

regulatory disclosures that are to be reported by

the NBFCs. Recently, through the Scale based

regulations (SBR), RBI has advocated additional

disclosures in the nancial statements for nancial

periods ending 31 March 2023 and onwards. RBI

also provided clarications on these disclosure

requirements through its circular dated 19 April 2022

on ‘Disclosures in Financial Statements - Notes to

Accounts of NBFCs’.

The additional disclosure requirements for NBFCs in

accordance with the SBR framework are outlined below:

12

Financial Services Sector supplement

Note 1:

Exposure to capital market: The RBI, vide its SBR

disclosure guidelines, now requires NBFCs in all layers

to provide the below mentioned additional details in the

disclosure on ‘exposure to the capital market’:

•

Underwriting commitments taken up by the NBFCs

in respect of primary issue of shares or convertible

bonds or convertible debentures or units of equity

oriented mutual funds

•

Financing to stockbrokers for margin trading

•

All exposures to Alternative Investment Funds:

•

Category I

•

Category II

•

Category III

Note 2:

Sectoral exposure: Currently, SI-NBFCs (i.e., NBFCs that

are systemically important) and HFCs are required to

disclose sector-wise NPAs for the following sectors with

column - percentage of NPAs to Total Advances in that

sector:

•

Agriculture and allied activities

•

MSME

•

Corporate borrowers

•

Services

•

Unsecured personal loans

•

Auto loans

•

Other personal loans

NBFCs in all layers of the SBR framework are now

required to provide disclosures of total exposure (on and

off-balance sheet), gross NPAs and percentage of gross

NPAs to total exposure along with comparatives of the

previous year in the below mentioned sectors:

•

Agriculture and allied activities

•

Industry (additional sectors are required to be

disclosed within industry)

•

Services (additional sectors are required to be

disclosed within services)

•

Personal loans (additional details are required to be

disclosed within personal loans)

•

Others, if any.

If exposure to a specic sub-sector/industry within each

sector is more than 10% of the Tier I capital of an NBFC

(material subsector), then exposure to the material sub-

sector is required to be disclosed separately within that

sector. Exposures to other sub-sectors/industry within

each sector, which is less than 10% of the Tier I capital of

the NBFC, are required to be aggregated and disclosed as

‘others’ within each sector.

Note 3:

Intra group exposures: NBFCs shall make the following

disclosures for the current year with comparatives for the

previous year:

•

Total amount of intra-group exposures

•

Total amount of top 20 intra-group exposures

•

Percentage of intra-group exposures to total exposure

of the NBFC on borrowers/customers

13

Financial Services Sector supplement

CY= Current Year | PY= Previous Year

@

Disclosures for directors and relatives of directors should be made separately in separate columns from other KMPs and

relatives of other KMPs.

#

The outstanding at the year end and the maximum during the year are to be disclosed

*Specify item if the total for the item is more than 5% of total related party transactions. Related parties would include

trusts and other bodies in which the NBFC can directly or indirectly (through its related parties) exert control or signicant

inuence.

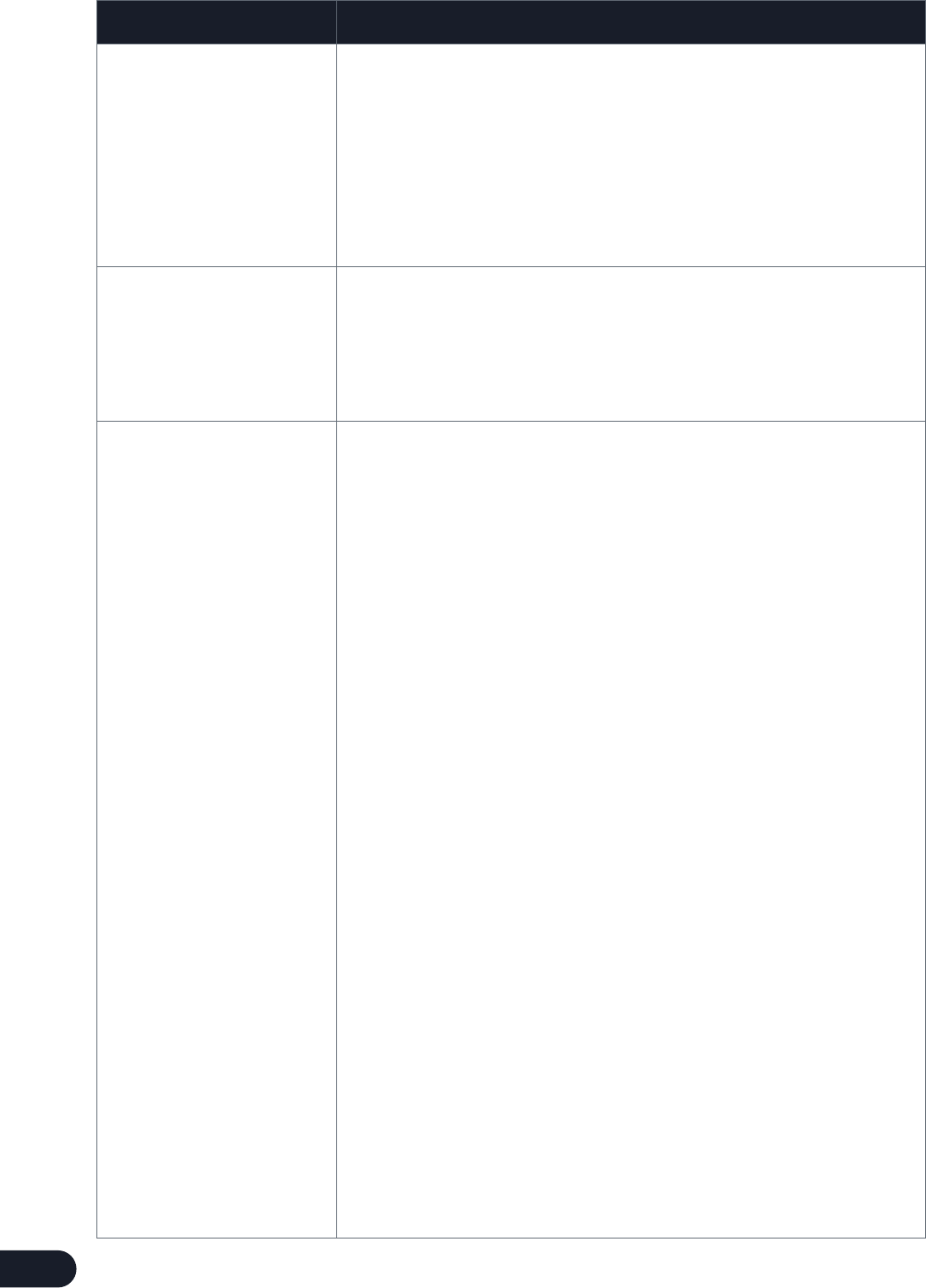

Note 4:

Related party disclosure: Disclosure is required to be

given in the following format:

Particulars

Parent

(as per ownership

or control)

Subsidiaries

Associates/

Joint ventures

Key

Management

Personnel

@

Relatives of Key

Management

Personnel

@

Other* Total

CY PY CY PY CY PY CY PY CY PY CY PY CY

PY

Borrowings

#

Deposits

#

Placements of

deposits

#

Advances

#

Investments

#

Purchase of

xed/ other

assets

Sale of xed/

other assets

Interest paid

Interest received

Other*

•

Related party, in the context of the aforementioned

disclosure, would include all related parties as per the

applicable accounting standards. Further, the related

party shall also include details of related parties as

dened under Section 2(76) of the Companies Act,

2013.

•

Key Management Personal (KMPs) at minimum shall

include details of key managerial personnel as per

section 2(51) of the Companies Act, 2013

•

Relatives of KMPs at the minimum, shall include

details of relatives as dened under section 2(77)

of the Companies Act, 2013 and Rule 4 of the

Companies (Specication of denitions details) Rules,

2014

Note 5:

Disclosure of complaints: The guidelines now require

NBFCs in all layers of the SBR framework to include the

certain additional disclosures with regard to customer

complaints in a prescribed format. The disclosures are as

follows:

•

Instead of reporting the number of complaints

redressed, NBFCs will now disclose the number of

complaints disposed during the year (which includes

the number of complaints rejected by the NBFC)

•

Details of maintainable complaints received by

the NBFC from the Ofce of the Ombudsman (this

includes a number of complaints resolved in favor

of the NBFC, number of complaints resolved after

passing of awards against the NBFC, and complaints

resolved through conciliation/mediation/ advisories)

•

Number of awards unimplemented within the

stipulated time (other than those appealed)

•

Top ve grounds of complaints received by the

NBFCs from customers along with details regarding

pending at beginning of year, received during the year,

percentage increase/decrease in complaints, pending

at the end of the year (including details of complaints

pending for more than 30 days).

(Amount in INR crores)

14

Financial Services Sector supplement

Note 6:

Corporate governance: Securities and Exchange Board

of India (Listing Obligations and Disclosure Requirements)

Regulations, 2015 (Paragraph C of Schedule V - Annual

Report) as amended from time to time, species

disclosures to be made in the section on the corporate

governance of the Annual Report. With respect to the

corporate governance report, non-listed NBFCs should also

endeavor to make full disclosure in accordance with the

requirement of SEBI (LODR) Regulation, 2015. Non-listed

NBFCs at the minimum should disclose the following under

the corporate governance section of the annual report:

•

Composition of the Board

•

Details of change in composition of the BoD during

the current and previous nancial year

•

Reasons for resignation given by independent

director, where such resignation is before completion

of his/her term

•

Relationship amongst the directors inter-se

•

Committees of the Board and their composition

(including the terms of reference of the committee, etc.)

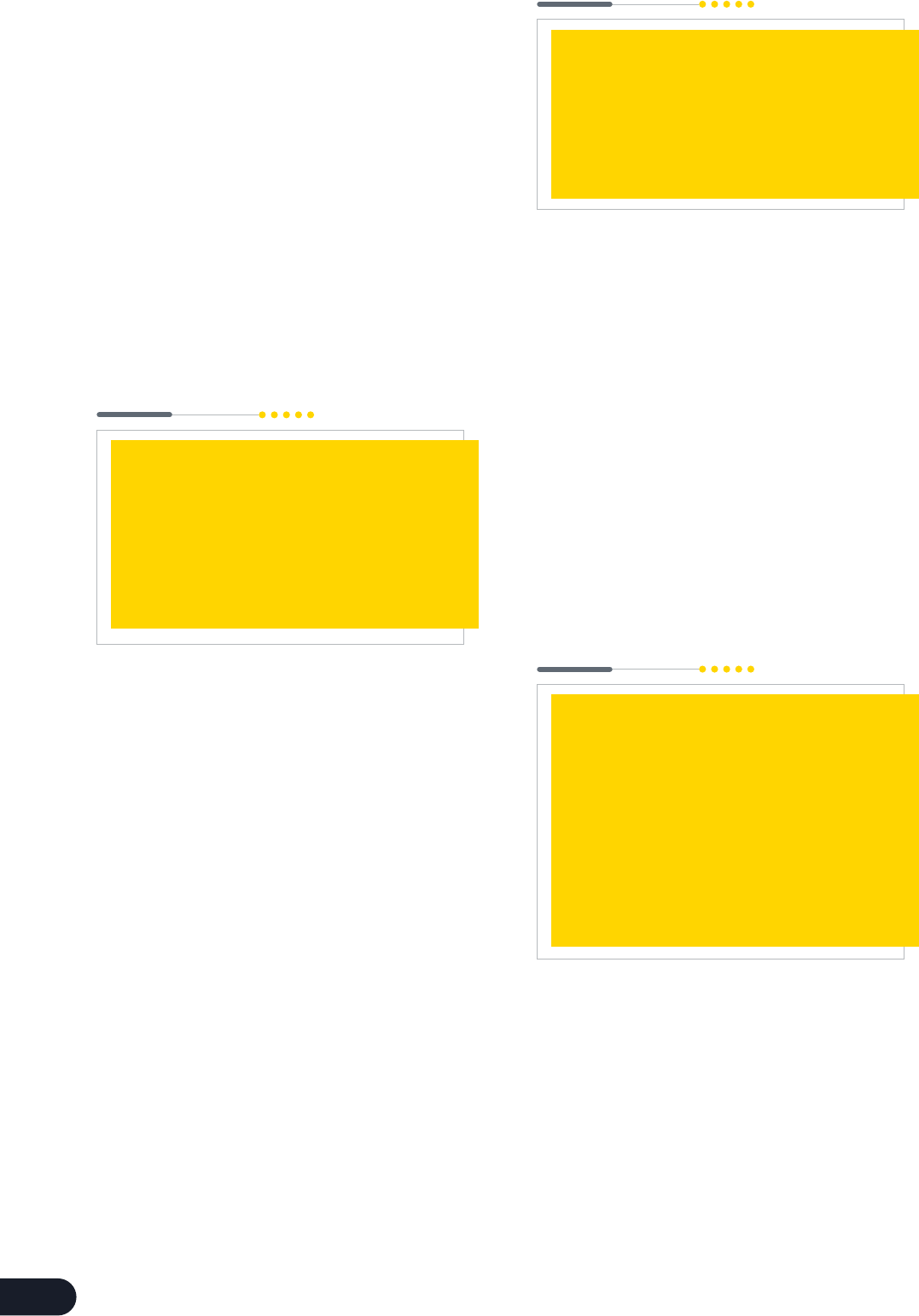

Table 1

S r. Particulars Amount

1 Gross NPAs as on March 31, 20XX* as reported by the NBFC

2 Gross NPAs as on March 31, 20XX as assessed by the RBI/ NHB

3 Divergence in Gross NPAs (2-1)

4 Net NPAs as on March 31, 20XX as reported by the NBFC

5 Net NPAs as on March 31, 20XX as assessed by the RBI/ NHB

6 Divergence in Net NPAs (5-4)

7 Provision for NPAs as on March 31, 20XX as reported by the NBFC

8 Provision for NPAs as on March 31, 20XX as assessed by the RBI/ NHB

9 Divergence in provisioning (8-7)

10 Reported Prot before tax and impairment loss on nancial instruments for the year ended

March 31, 20XX

11 Reported Net Prot after Tax (PAT) for the year ended March 31, 20XX

12 Adjusted (notional) Net Prot after Tax (PAT) for the year ended March 31, 20XX after

considering the divergence in provisioning

*March 31, 20XX is the close of the reference period in respect of which divergence were assessed

How we see it: Certain information mentioned under the guidelines were already being reported by NBFCs, for

example disclosure pertaining to related party, disclosures on corporate governance by listed NBFCs, etc. Apart

from the information already disclosed, few information to be disclosed are new requirements. The NBFCs will have

to evaluate as to how they want to disclose the information in their nancial statements, but they will have to ensure

that there is no duplication of information, and the details are presented in a way that it is useful for the investors

and other stakeholders to comprehend. NBFCs will also need to have a process in place to collate the required

information as per prescribed format. The above guidelines will be effective for annual nancial statements for the

year ending 31 March 2023.

•

General Body Meetings (giving details of date, place

and special resolutions passed at the meetings)

•

Details of non-compliance with requirements of the

2013 Act (reasons for non-compliances should also

be provided, including for accounting and secretarial

standards)

•

Details of penalties and strictures imposed on the

NBFC by RBI or any other statutory authority.

Note 7:

Divergence in asset classication and provisioning:

The disclosure of divergence in asset classication and

provisioning is required to be provided in accordance

with the format (Table 1) as given below. Disclosures

of divergence would be required if either or both of the

following conditions are satised:

•

The additional provisioning requirements assessed by

RBI (or National Housing Bank (NHB) in the case of

Housing Finance Companies (HFC)) exceed 5% of the

reported prots before tax and impairment loss on

nancial instruments for the reference period, or

•

The additional Gross NPAs identied by RBI/ NHB

exceeds 5% of the reported Gross NPAs for the

reference period

15

Financial Services Sector supplement

6

Provisioning requirement for investment in Security Receipts (SRs)

Clause 77 of the Master Direction – Reserve Bank of India

(Transfer of Loan Exposures) Directions, 2021 (“MD-

TLE”) states that Investments by lenders in SRs/ Pass

Through Certicates (PTCs) / other securities issued by

Asset Reconstruction Company (ARCs) shall be valued

periodically by reckoning the Net Asset Value (NAV)

declared by the ARC based on the recovery ratings

received for such instruments.

The current circular provides a glide path to the entities

(RRBs) which were kept out of Circular “Guidelines on

Sale of Stressed Assets by Banks” dated 01 September

2016 and ensure smooth implementation of clause

77 of the MD-TLE . The circular provides clarication

on the computation of valuation of investments in SRs

outstanding on the date of issuance of MD-TLE (24

September 2021):

a. The difference between the carrying value of such SRs

and the valuation arrived at as on the next nancial

reporting date after the date of issuance of MD-TLE,

in terms of clause 77 of the MD-TLE, to be provided

over a ve-year period starting with the nancial year

ending March 31, 2022, till FY 2025-26.

b. Subsequent valuations of investments in such SRs

on an ongoing basis shall be as per terms of the

provisions of MD-TLE.

All lending institutions shall put in place a board approved

plan to ensure that the provisioning made in each of the

nancial years as per above clause (a) is not less than one

fth of the required provisioning on this count.

Valuation of investments in SRs made after the issuance

of MD-TLE shall be as per terms of the provisions

thereunder.

16

Financial Services Sector supplement

Section 1

Banks and NBFCs

Other

regulatory changes

1. Discussion Paper (DP) on Expected credit loss Framework for Provisioning by Banks

2. Requirement of compliance function and role of Chief Compliance Ofcer (CCO)

3. Guidelines on Compensation of Key Managerial Personnel (KMP) and Senior

Management in NBFCs

4. Updates on scale-based regulations

5. Guidelines on digital lending

6. Discussion Paper (DP) on Securitisation of Stressed Assets Framework (SSAF) –

Applicable to all Banks and NBFCs

7. Review of regulatory framework for Asset Reconstruction Companies (ARCs)

8. Some of the key master directions which are updated by the RBI during the FY

2022-23

B

17

Financial Services Sector supplement

On 16 January 2023, RBI released the ‘Discussion

Paper (DP) on Introduction of Expected Credit Loss

(ECL) Framework for Provisioning by Banks’. The DP

proposes a framework for adoption of an expected loss

framework and includes discussion questions on which a

nal view shall be taken based on the feedback received

and after analyzing comprehensive data. The feedback/

comments/ suggestions are to be submitted to the RBI

by 28 February 2023, basis which the RBI shall issue the

nal guidelines.

As per the extant requirements, banks follow the

‘incurred loss’ approach, wherein the level of provisions

is contingent on the asset classication of a particular

exposure. While nalizing the framework under the

expected credit loss approach, RBI has considered the

guidance under IFRS 9 Financial Instruments and ASC

326 - Financial Instruments – Credit Losses under the

US GAAP. However, RBI has proposed to introduce the

expected credit loss approach as per IFRS 9 for loss

provisioning supplemented by regulatory backstops. In

the DP, RBI has also proposed to adopt the principles laid

out by Basel Committee on Banking supervision (BCBS).

Some key takeaways from the DP are:

•

The DP proposes to apply the ECL approach to only

scheduled commercial banks. RRBs and co-operative

banks have currently been excluded from the

application.

•

The DP specically mentions the assets on which ECL

would be applicable (all loans and advances including

irrevocable loan commitments (including sanctioned

limits under revolving credit facilities), Lease

receivables, Irrevocable nancial guarantee contracts,

and Investments classied as held-to-maturity or

available-for-sale). It also applies to contractual

guarantees, examples of contractual guarantees

would be performance guarantees and bid-bond

guarantees.

1

Discussion Paper (DP) on Expected Credit Loss Framework for

Provisioning by Banks

How we see it: The DP specically mentions the exact

scope of assets to which ECL model would be applied

but is silent on other nancial assets which would

otherwise get scoped-in under IFRS 9.

Also, under IFRS 9 contractual guarantees are

generally not covered unless they meet the denition

of a nancial guarantee and consequently ECL

requirements are not applicable for such contractual

guarantees.

Under IFRS 9, there is a policy choice (simplied

approach or general approach) to measure the loss

allowance for lease receivables, whereas the DP

proposes that lease receivables should always be

measured at an amount equal to lifetime expected

credit losses.

RBI issued a Discussion Paper released on ‘Review

of Prudential Norms for Classication, Valuation and

Operations of Investment Portfolio of Commercial

Banks’ (DP on Investment Portfolio) in January 2022,

this paper provides guidance on measurement of

Assets held for sale (AFS) securities and impairment

methodology to be followed for held till maturity

(HTM) securities. Further clarication may be

provided by RBI regarding the applicability of

impairment guidance on Investment portfolio as per

DP on Investment Portfolio or as per DP on ECL, in

case both DP are nalized by RBI.

How we see it: In the case of ‘low credit risk

expedient’, it appears that there is a carve out

proposed from the requirements of IFRS 9 to

allow the use of the practical expedient only to

instruments specied above.

•

The DP specically mentions that it is proposed to

allow the use of the ‘low credit-risk’ practical expedient

in respect of SLR eligible investments; direct claims on

central government (i.e., excluding claims that arise

from exposures that are guaranteed by the central

government); and exposures that are guaranteed by

the central government, provided that the guarantee

contains suitable clauses mandating invocation within

a specied period (say, 30 days) from the event of

default and payment of the guarantee amount will

be received within a reasonable period (say, 60 days)

after the invocation.

18

Financial Services Sector supplement

How we see it: While detailed guidelines for

treatment of restructured assets is provided in the

current Income Recognition and Asset Classication

and Provisioning (IRACP) norms, specic guidance

may be required as to what would construe as a

restructured asset (as dened under IRACP norms)

and a modied asset other than restructured to

avoid any scope for misinterpretation.

How we see it: It appears that the denition of

default is very similar to the denition provided

under IFRS 9 for credit impaired assets. As per

the DP the default is required to be evaluated at

counter-party level and hence banks would need to

make appropriate system changes to capture the

default at counter-party level and also ensure that

all elements mentioned in the denition of default

are adequately covered.

•

IFRS 9 does not dene “default”, but there is a

rebuttable presumption that default does not occur

later than when a nancial asset is 90 days past due

unless an entity has reasonable and supportable

information to demonstrate that a more lagging

default criterion is more appropriate. ‘Default’ has

been specically dened in the DP as follows:

•

The counterparty is classied as a non-performing

asset (NPA) under the extant guidelines of RBI.

•

The exposure to the counterparty has been

restructured by the bank and such exposure

continues to be in the ‘monitoring period’; or

•

The bank considers that the borrower is unlikely

to pay its existing debt. A non-exhaustive list of

indicators of unlikeliness to pay is also included in

DP.

•

Exposures that are overdue for a continuous

period of 90 days.

•

DP proposes specic guidelines for restructured

assets which are as follows:

•

The exposures which are restructured will have

to be treated as credit-impaired till satisfactory

performance is demonstrated post such

restructuring.

•

Restructured assets that are in the monitoring

period and are performing satisfactorily will

be subject to a xed prudential oor for loss

provisioning regardless of the time spent as a

Stage 3 asset. Once the asset exits the monitoring

period successfully and enters the remaining

specied period, the asset can be classied as

Stage 2.

•

Banks should test renegotiated and modied

nancial assets other than restructured assets

for a signicant increase in credit impairment by

comparing the risk of default occurring at the

reporting date with that at the initial recognition.

•

The DP has proposed criteria for determining

signicant increase in credit risk (SICR) which

includes ‘watch-list’ accounts and nancial assets for

which contractual payments are 30 days past due

(rebuttable presumption). A non-rebuttable backstop

of 60 days past due to be assessed at counterparty

level has also been proposed by the DP.

•

The DP proposes that “Watch-list” or equivalent

classication for stressed exposures, as reported to

the Board or Board-level Committees based on Board

approved policies of the banks should also be assessed

as exposures where signicant increase in credit risk

has been evidenced since initial recognition.

•

While IFRS 9 does not explicitly dene the tenure of

‘cooling-off period’, the DP specically mentions that

an asset in Stage 3 shall not directly be brought to

Stage 1 even after the irregularities are rectied and

the asset shall be kept in Stage 2 for minimum six

months after all the irregularities are rectied, before

the same is brought to Stage 1.

How we see it: As per the extant guidelines, an

NPA may be upgraded to a standard asset once all

irregularities have been rectied, i.e., all arrears of

principal and interest have been paid. There is no

specic requirement to observe a cooling-off period

for upgrading an asset.

As per the DP ‘cooling-off’ period will have to be

observed for stage 3 assets (for restructured assets

a separate cooling-off period is suggested) which

may be cumbersome and entail system changes to

ensure that correct staging criteria is adequately

captured for the assets.

•

The DP proposed that interest recognition in respect

of Stage 3 assets should be based on actual receipt of

cash ows and not on an accrual basis. This is a carve-

out when compared to IFRS 9. As per IFRS 9 interest

on stage 3 assets is accrued by applying the effective

interest rate on the net carrying amount of the

nancial asset, i.e., carrying amount of the nancial

asset after adjusting for expected credit losses.

•

The DP proposes that each bank will be permitted to

design and implement its own models for measuring

expected credit losses. Additionally, the models shall

be required to undergo a process check based on

standard principle/considerations. One option could be

for the banks to get the models externally validated,

and such reports may need to be placed before the

audit committee.

19

Financial Services Sector supplement

How we see it: As per the extant guidelines, the

collaterals such as immovable properties charged

in favor of the bank should be valued once in three

years by valuers appointed as per the guidelines

approved by the Board of Directors.

One of the options discussed in the DP requires a

distressed valuation of collaterals to be carried out

once in 12 months. This would entail signicant

time and cost from the Bank’s perspective. The

banks would also face severe operational and

administrative challenges for the distress valuation

of retail loans.

The DP is silent on the valuation techniques for the

collaterals for LGD computation.

How we see it: While the Banks have been

submitting pro-forma Ind AS nancial statements

to the RBI they may have to relook/analyze their

methodologies and calculations to align with the

specic guidance that is mentioned in this DP. RBI

may further clarify whether it requires the Banks to

prepare its Pro-forma nancial statements under

Ind AS 109 or as per the guidance suggested in the

DP.

Banks may have to hire an external consultant

for model development, validation, and review.

They will also have to develop detailed model

documentation which adequately captures the

approach, assumptions and judgement that is

adopted for ECL calculation.

Banks will have to develop policies and governance

framework for ECL which adequately denes the

roles and responsibilities, validation process (back

testing), frequency, method to assess management

overlays, etc.

A data and system gap assessment may also be

required to be carried out to ensure the adequate

ECL methodology is in place once the nal

guidelines are announced by the RBI.

•

One of the key proposals of the DP is that the credit

loss estimates arrived at by the banks using their

respective models would be subject to a prudential

oor prescribed by RBI as a regulatory backstop.

It is proposed that the expected credit loss (ECL)

measured in respect of an asset classied as Stage

1 as well as Stage 2 or 3 will be subject to prudential

oors to be calibrated based on a comprehensive data

analysis, rather than merely re-prescribing extant

norms. The prudential oors will be subject to a

step-up prescription depending upon the time that a

nancial instrument spends as a Stage 2 or 3 asset.

Actual specications shall be included in the Draft

Guidance. The DP chalks out key issues and options

around the determination of ‘specic’ and ‘general’

provision for stage 2 assets as follows:

•

to treat the entire provisions held in respect of

Stage 2 assets, including the additional provisions

required to be maintained to meet the prudential

oor, as general provisions.

•

or alternatively, to treat the estimated ECL

provisions (without considering the applicable

prudential oor) as specic provisions while

permitting any additional provisions held as general

provisions.

•

As transition provisions, the DP provides that the

difference between the accounting provisions held

on adoption of ECL approach as on the effective

date and the provisions computed as per the extant

provisioning norms, net of tax effects, may be allowed

to be added back to the Common Equity Tier 1 (CET

1) capital. This benet shall be phased out over a

maximum ve year- period. Banks may also choose to

spread the transition over a shorter period.

•

The DP also chalks out key issues and options around

the determination of ‘Secured’ and ‘Unsecured’

exposure for the purpose of arriving at the prudential

oors as follows:

•

a nancial asset should be treated as secured only

to the extent of distressed valuation of the security

cover available in respect of such asset. To ensure

that the valuation correctly captures the prevailing

economic conditions, such distressed valuation

should be not older than twelve months; or

•

Unsecured exposure should be dened as an

exposure where the realisable value of the security,

as assessed by the bank/approved valuers/Reserve

Bank’s inspecting ofcers, is not more than 51%

or a higher percentage to be specied, ab initio, of

the outstanding exposure; or

•

Factor in the valuation of the collaterals during

the calibration of the prudential oor and issue

guidance for valuation of collateral to be reckoned

for the computation of the loan loss provisions

under the ECL model used by the banks.

20

Financial Services Sector supplement

How we see it: It is expected that the provision for

ECL would have a signicant impact on the Bank’s

protability and consequently on capital adequacy

and leverage. Banks need to gear up and estimate

the potential impact on their nancial statements

and regulatory ratios. Additional clarication/

guidance on the transitional provisions for recording

the impact in the nancial statements may be

required. For example, whether impact needs to be

given in opening reserves for the reporting period in

which ECL is adopted.

•

It is also proposed to prescribe a non-exhaustive list

of disclosures that banks would be required to make

upon the adopting ECL approach for loss provisioning.

Other considerations

Computation of loan loss provisioning as per ECL will

be very crucial for the Banks. In-order to implement the

ECL as per the guidance provided in the DP will require

the Banks to take into consideration the following

aspects.

•

Business: Under IFRS 9, the behavior of the

borrower after origination will become a very

important indicator of volatility in ECL provision.

Hence, it will become very important to align the

key performance indicators of the business teams

with the ECL provisions determined. The internal

management reporting (MIS) and business metrics

would require reassessment. ECL provision amount

and the methodology adopted will reect strongly

on the credit risk management practices followed

by the banks and pricing of loans. The current

communication content to the stakeholders may also

require suitable modication.

•

Data: Signicant historical data is required for the

determination of ECL, such as data pertaining to past

default rates across portfolios, recovery/collection

related data across portfolios, etc. Banks will have to

start the process of identication of data points and

the systems from which it will be sourced.

•

Systems: Risk models and data will have to be more

extensively used to make the assessments and

calculations required for accounting purposes, which

are both a major change from the extant regulations

and a key challenge.

Signicant system enhancements may be required,

or banks may have to evaluate whether investment

in developing a suitable IT infrastructure for ECL

modelling is required.

•

Governance: One more key aspect that Banks

need to consider is that audit trail is available for

the ECL provision amount to be suitably audited

by the auditors. A lot of elements are involved in

the ECL such as probability of default (PD), loss

given default (LGD), and exposure at default (EAD),

macro-economic overlay; audit trail for each of these

elements would be necessary for the auditors to get

comfort on the same.

Systems and processes that the Bank will build, and

associated controls will need to be appropriately

streamlined to deliver reliable results that are

subject to appropriate review and back testing.

Further, as the composition of the portfolio changes,

market condition changes and the ECL methodology

and assumptions will have to be accordingly

adapted/changed. Hence, strong governance and

controls will be required.

•

Training: Banks would have to consider training its

personnel or hiring people with relevant skill sets to

work on the ECL modelling, quantifying and nancial

reporting.

Lastly, the Bank may want to start engaging with their

statutory auditors to take them through the current ECL

computation and take their inputs on the methodology

and assumptions used in the calculation.

The transition to ECL will be a signicant milestone and

is likely to result in signicant time and efforts for banks

and will call for major investment and involvement of

senior management. Further, it is not merely a nancial

reporting change, as the impact could be pervasive

in nature. However, the adoption of ECL framework

shall strengthen the Indian Banking system with more

pro-active measures required from the bank’s end and

timely recognition of losses.

21

Financial Services Sector supplement

Upper Layer (NBFC-UL) and Middle Layer (NBFC-ML) are

required to have an independent Compliance Function

and a Chief Compliance Ofcer (CCO). NBFC-UL and

NBFC-ML should have in place Board approved policy

and a Compliance function including appointment of

CCO latest by 01 April 2023 and 01 October 2023,

respectively.

Framework for compliance function and role of CCO

Compliance function shall ensure strict observance of

all statutory and regulatory requirements for the NBFC,

including standards of market conduct, managing conict

of interest, treating customers fairly and ensuring the

suitability of customer service.

Responsibility of the Board and senior management

The Board / Board Committee shall ensure that

an appropriate compliance policy is in place and

implemented and prescribe the periodicity for review of

compliance risk.

The senior management shall:

•

at least once a year identify and assess the major

compliance risk facing the NBFC and formulate plans

to manage it.

•

submit to the Board / Board Committee a review

at the prescribed periodicity and a detailed annual

review of compliance; and

•

report promptly to the Board / Board Committee on

any material compliance failure while ensuring that

appropriate remedial or disciplinary action is taken.

Responsibilities of compliance function

•

Assist the Board and the senior management in

overseeing the implementation of compliance policy,

including policies and procedures, prescriptions in

compliance manuals, internal codes of conduct, etc.

•

Play the central role in identifying the level of

compliance risk in the organization in existing / new

products and processes and appropriate risk mitigants

shall be put in place. CCO shall be a member of the

‘new product’ committees. All new products shall be

subjected to intensive monitoring for at least the rst

six months.

•

Compliance function shall monitor and test

compliance by performing sufcient and

representative compliance testing and reporting

such results to the senior management. Circulate

periodically the instances of compliance failures

among staff, along with the required preventive

instructions. Staff accountability shall be examined for

major compliance failures.

•

Ensure compliance of regulatory/ supervisory

directions given by RBI in both letter and spirit in a

time-bound and sustainable manner. Unsatisfactory

compliance with Risk Mitigation Plan (RMP) /

2

Requirement of compliance function and role of Chief Compliance

Ofcer (CCO)

Monitorable Action Plan (MAP) may invite penal action

from RBI.

•

Attend to compliance with directions from other

regulators in cases where the activities of the entity

are not limited to the regulation/supervision of RBI.

Further, discomfort conveyed to the NBFC on any

issue by other regulators, and action taken by any

other authorities / law enforcement agencies, shall be

brought to the notice of RBI.

•

The compliance department may also serve as

a reference point for the staff from operational

departments for seeking clarications / interpretation

of various regulatory and statutory guidelines.

The CCO shall be the nodal point of contact between

the NBFC and the regulators / supervisors and shall

necessarily be a participant in the structured or other

regular discussions held with RBI. Compliance with

RBI inspection reports shall be communicated to

RBI necessarily through the ofce of the compliance

function.

In some NBFCs, if there are separate departments/

divisions looking after compliance with different

statutory and other requirements. In such cases,

the departments concerned shall hold the prime

responsibility for their respective areas, which shall

be clearly outlined. Adherence to applicable statutory

provisions and regulations is the responsibility of each

staff member. However, the Compliance Function would

need to ensure overall oversight.

Broad contours of compliance framework in NBFCs

A. Compliance policy: The NBFC should have a Board-

approved compliance policy mentioning its compliance

philosophy, expectations on compliance culture,

structure and role of the compliance function, the

role of CCO, processes for identifying, assessing,

monitoring, managing, and reporting on compliance

risk. The policy shall be reviewed at least once a year.

It should cover the following aspects:

•

Measures to ensure the independence of the

Compliance function and its right to freely disclose

ndings and views to senior management, the Board /

Board Committee.

•

Focus on various regulatory and statutory compliance

requirements.

•

Monitoring mechanism for the compliance testing

procedure.

•

Reporting requirements, including compliance

risk assessment and change in risk prole, etc. to

the senior management and to the Board / Board

Committee.

•

The authority of the compliance function to have

access to information as specied in “authority”

below.

22

Financial Services Sector supplement

•

A mechanism for dissemination of information on

regulatory prescriptions and guidelines among staff

and periodic updating of operational manuals; and

•

The approval process for all new processes and

products by the compliance department, prior to their

introduction.

B. Compliance structure: The compliance department

shall be headed by the Chief Compliance Ofcer.

NBFCs are free to adopt their own organizational

structure for the compliance function. The function

shall be independent and sufciently resourced,

its responsibilities shall be clearly specied, and its

activities shall be subject to periodic and independent

review.

C. Compliance programme: The NBFC shall carry out an

annual compliance risk assessment in order to identify

and assess major compliance risks faced by them and

prepare a plan to manage the risks. The annual review

by the senior management shall cover at least the

following aspects:

•

Compliance failures, if any, during the preceding year

and consequential losses and regulatory action, as

also steps taken to avoid recurrence of the same.

•

Listing of all major regulatory guidelines issued

during the preceding year and steps taken to ensure

compliance.

•

Compliance with fair practices codes and adherence

to standards set by self-regulatory bodies and

accounting standards; and

•

Progress in the rectication of signicant deciencies

and implementation of recommendations pointed out

in various audits and RBI inspection reports.

D. Authority: The CCO and compliance function shall

have the authority to communicate with any staff

member and have access to all records or les

that are necessary to enable her / him to carry out

entrusted responsibilities in respect of compliance

issues. This authority shall ow from the compliance

policy of the NBFC.

E. Dual hatting

•

There shall not be any ‘dual hatting,’ i.e., the CCO shall

not be given any responsibility which brings elements

of conict of interest, especially any role relating to

business.

The CCO shall not be a member of any committee which

conicts her / his role as CCO with responsibility as a

member of the committee, including any committee

dealing with purchases / sanctions. In case the CCO is a

member of any such committee, that would only be an

advisory role.

•

The staff in the compliance department shall primarily

focus on compliance functions. However, they could

be assigned some other duties while ensuring that

there is no conict of interest.

F. Qualications and stafng of compliance function:

Apart from having staff with basic qualications

and practical experience in business lines / audit

and inspection functions, Compliance Function shall

have adequate staff members with knowledge of

statutory / regulatory prescriptions, law, accountancy,

risk management, information technology, etc.

Appropriate succession planning shall be ensured to

avoid any future skill gap.

G. Internal audit and independent review of compliance

function: Compliance risk shall be included in the

risk assessment framework of the internal audit

function, and compliance function shall be subject

to regular internal audit. CCO should be informed of

audit ndings related to compliance, which serves

as a feedback mechanism for assessing the areas of

compliance failures.

H. Supervisory focus: Examination of compliance rigor

prevalent in the NBFC shall be a part of Reserve

Bank’s supervisory risk assessment process.

I. Appointment and tenure of CCO

•

Tenure: Minimum xed tenure should be of not less

than three years. The Board / Board Committee may

relax the minimum tenure by one year in exceptional

cases, provided appropriate succession planning is put

in place.

•

Removal: Can be transferred / removed before

completion of the tenure only in exceptional

circumstances, with the explicit prior approval of

the Board / Board Committee, after following a

well-dened and transparent internal administrative

procedure.

•

Rank: Shall be a senior executive of the NBFC with

a position not below two levels from the CEO. In

NBFCs-ML, this requirement can be relaxed by one

level further. The CCO can also be recruited from the

market if required.

•

Skills: Have a good understanding of the industry and

risk management practices, knowledge of regulations,

legal requirements, and have sensitivity to supervisory

expectations.

•

Stature: Has the ability to exercise judgment

independently. She / He shall have the freedom and

authority to interact with regulators / supervisors

directly and ensure compliance.

•

Conduct: CCO shall have a clean track record and

unquestionable integrity.

•

Selection process: Selection of the candidate for

the post of the CCO shall be made based on a well-

dened selection process and recommendations

made by a committee constituted by the Board/

Board Committee for the purpose. The Board/

Board Committee shall take the nal decision in the

appointment of CCO.

•

Reporting Requirements: A prior intimation to

the Senior Supervisory Manager, Department

of Supervision, RBI, shall be provided before

23

Financial Services Sector supplement

appointment, premature transfer, resignation, early

retirement, or removal of the CCO. Such information

shall be supported by a detailed prole of the

candidate along with the ‘Fit and Proper’ certication

by the MD and CEO of the NBFC, conrming that

the person meets the prescribed supervisory

requirements and rationale for changes, if any. ‘Fit

and Proper’ criteria may be examined based on the

requirements spelled out in the Circular.

•

Reporting Line: The CCO shall have direct reporting

lines to the MD & CEO and / or Board / Board

Committee. In case the CCO reports to the MD and

CEO, the Board / Board Committee shall meet the CCO

at quarterly intervals on a one-to-one basis, without

the presence of the senior management, including

MD and CEO. The CCO shall not have any reporting

relationship with the business verticals. Further, the

performance appraisal of the CCO shall be reviewed

by the Board / Board Committee.

How we see it: Compliance function and risk

management framework are a critical part of the

corporate governance structure. NBFC (UL) and

(ML) shall put in place a Board approved policy and

a Compliance Function, including the appointment

of a Chief Compliance Ofcer (CCO), based on the

framework provided in the circular, latest by 01

April 2023 and 01 October 2023, respectively