1 PwC

pwc.in

Tax Insights

27 October 2023

RBI issues Master Direction (Non-Banking Company – Scale Based Regulation)

Directions, 2023

In brief

The Reserve Bank of India (RBI) issued the much-awaited Master Direction – Reserve Bank of India (Non-

Banking Financial Company – Scale Based Regulation) Directions, 2023 (MD) on 19 October 2023. The MD has

been issued in supersession of the existing Master Directions Systemically Important and Non-Systemically

Important NBFCs.

RBI has followed a streamlined approach by consolidating the provisions of the Master Directions applicable to

Systemically and Non-Systemically important NBFCs, certain provisions of the Scale Based Regulatory

Framework for NBFCs and the related circulars released by the RBI periodically, into one single Master Direction.

All the NBFCs, except the expressly exempt ones, shall be governed by this MD.

RBI has established a layered approach with incremental obligations being assigned to each layer, as the NBFC

progresses based on its asset size, scale of activity and perceived riskiness. For ease of reference, the MD is

divided into sections applicable for different categories of NBFCs, viz. NBFC-Base Layer, NBFC-Middle Layer,

NBFC-Upper Layer, etc. depending upon size and function.

The MD has come into force with immediate effect (i.e., 19 October 2023).

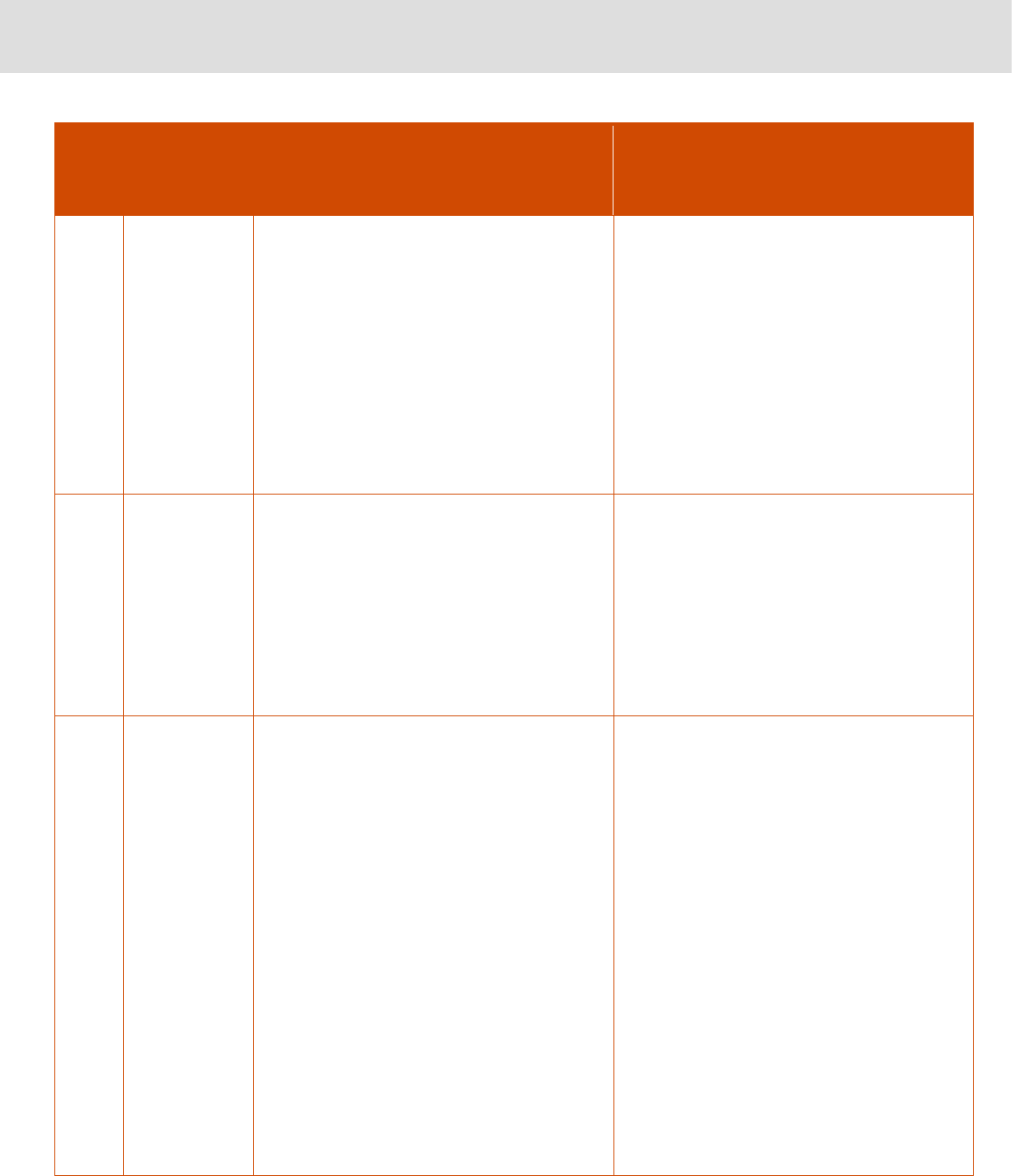

In detail

Given below is a brief overview of the key changes made in the MD v is-a-vis the previous Master Directions and

other Circulars:

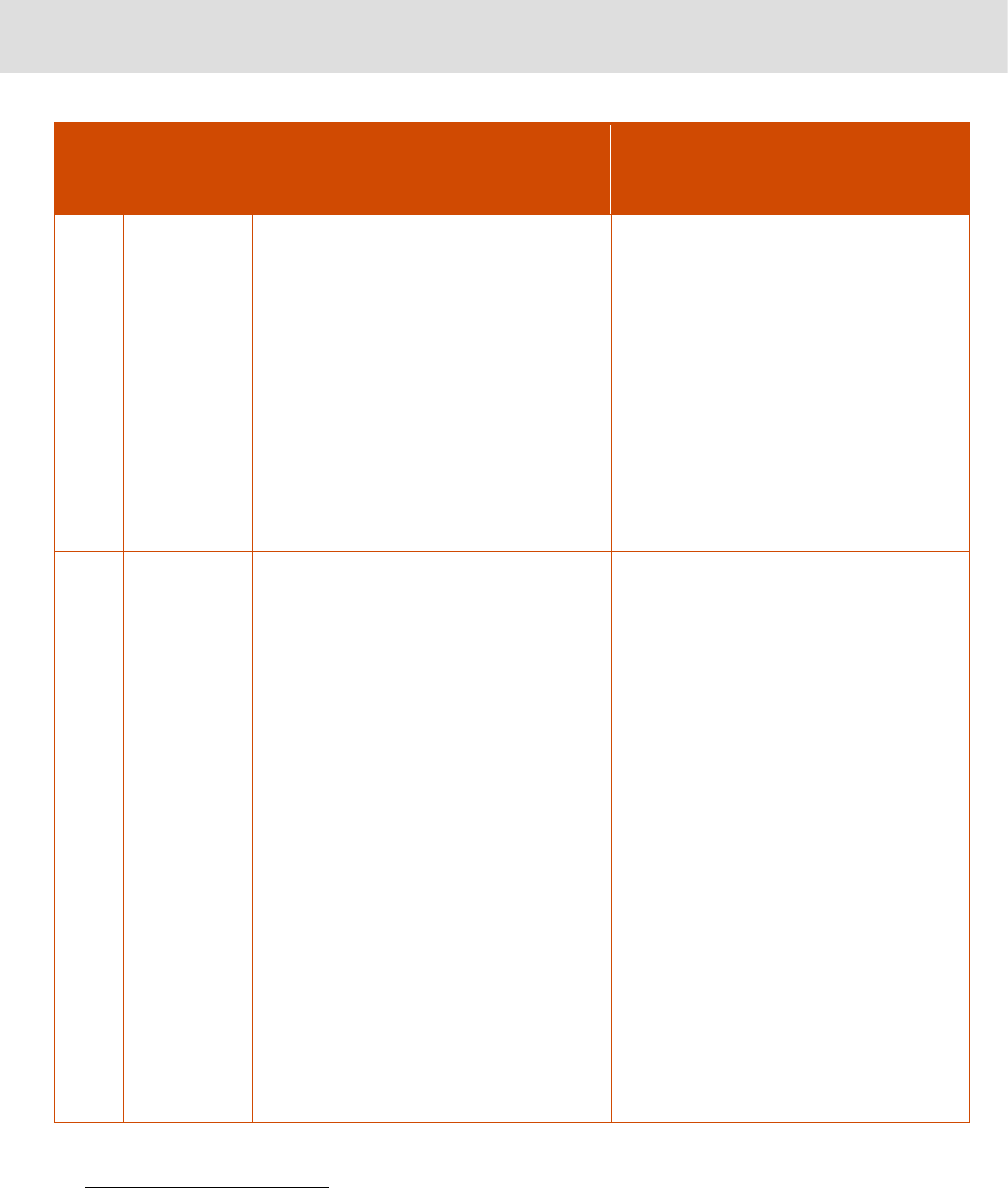

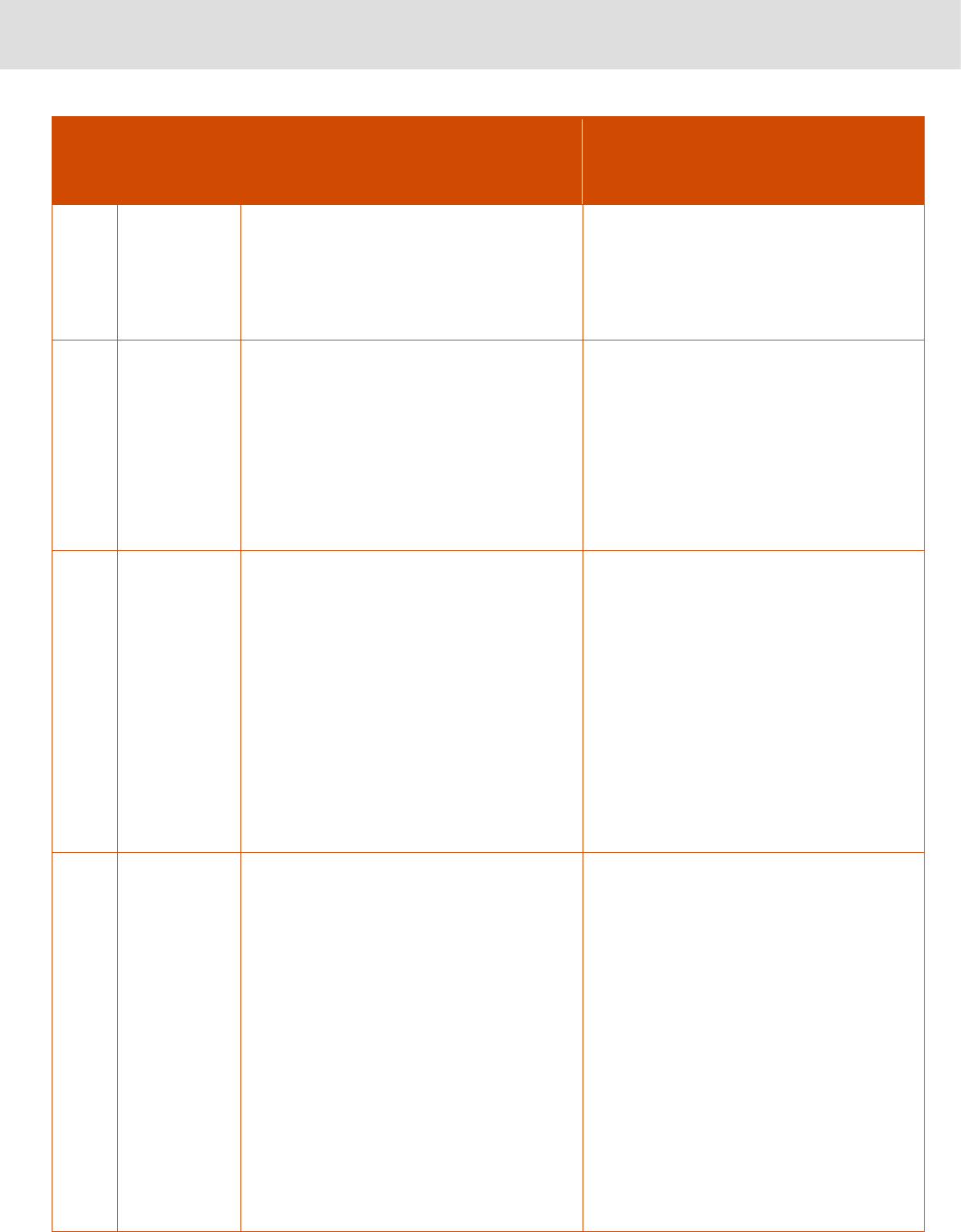

Overview of the Key Changes*

Sections from the previous MD that have

undergone change

Changes in the New MD

Abc

Sections deleted

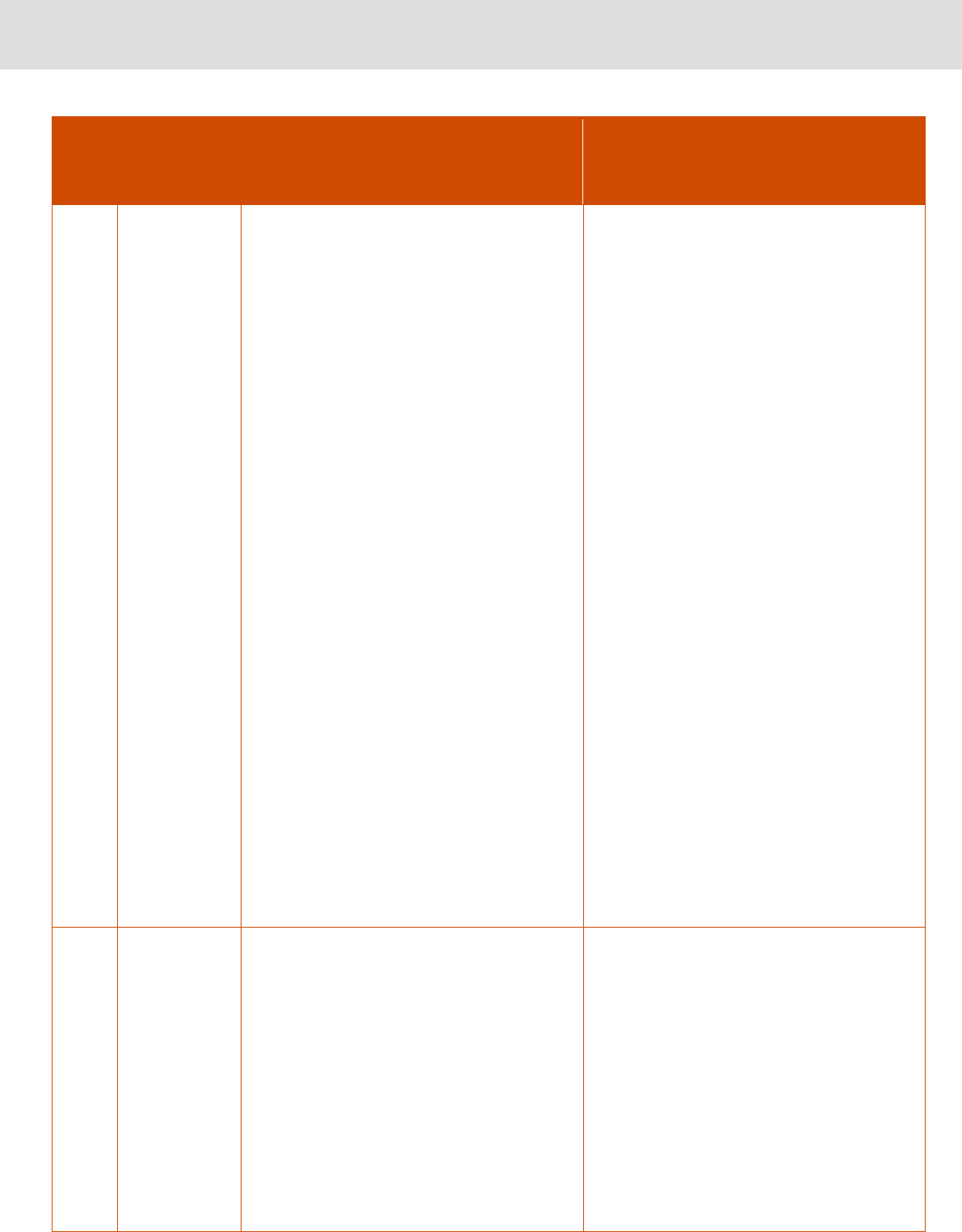

2 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

1.

Multiple

NBFCs in a

Group -

Classification

in Middle Layer

Para 3 of the Circular on Multiple NBFCs in a

Group: Classification in Middle Layer

If the consolidated asset (consolidation as per

para 2 above) size of the Group is ₹1000

crore and above, then each Investment and

Credit Company (NBFC-ICC), Micro Finance

Institution (NBFC-MFI), NBFC-Factor and

Mortgage Guarantee Company (NBFC-MGC)

lying in the Group shall be classified as an

NBFC in the Middle Layer and consequently,

regulations as applicable to the Middle Layer

shall be applicable to them.

Section I – Introduction

Para 2.8.2 - If the consolidated asset

(consolidation as per paragraph 2.8.1 above)

size of the NBFCs in the Group is ₹1000

crore and above, then each NBFC-ICC,

NBFC-MFI, NBFC Factor and MGC lying in

the Group shall be classified as an NBFC in

the Middle Layer and consequently,

regulations as applicable to the Middle Layer

shall be applicable to them. However, NBFC-

D, within the Group, if any, shall also be

governed under the Non- Banking Financial

Companies Acceptance of Public Deposits

(Reserve Bank) Direction, 2016.

2.

Criteria for

deciding

NBFC-ML

status

Criteria for deciding NBFC-ND-SI status

(1) Once an NBFC reaches an asset size of

₹500 crore or above, it shall be subject to the

regulatory requirements as per Non-Banking

Financial Company - Systemically Important

Non-Deposit taking Company and Deposit

taking Company (Reserve Bank) Directions,

2016, despite not having such assets as on

the date of last balance sheet. All such non-

deposit taking NBFCs shall comply with the

regulations/directions issued to NBFC-ND-SI

from time to time, as and when they attain an

asset size of ₹500 crore, irrespective of the

date on which such size is attained.

In a dynamic environment, the asset size of a

company can fall below ₹ 500 crore in a given

month, which may be due to temporary

fluctuations and not due to actual downsizing.

In such a case the company shall continue to

meet the reporting requirements and shall

comply with the extant directions as

applicable to NBFC-NDSI, till the submission

of its next audited balance sheet to the Bank

and a specific dispensation from the Bank in

this regard.

Section I - Introduction

Para 2.9.1: Criteria for deciding NBFC-ML

status - Once an NBFC reaches an asset size

of ₹1,000 crore or above, it shall be subject to

the regulatory requirements as per Section III

of these Directions, despite not having such

assets as on the date of last balance sheet.

All such non-deposit taking NBFCs shall

comply with the regulations/directions issued

to NBFCs-ML from time to time, as and when

they attain an asset size of ₹1,000 crore,

irrespective of the date on which such size is

attained.

Para 2.9.2 - In a dynamic environment, the

asset size of a NBFCs can fall below ₹1,000

crore in a given month, which may be due to

temporary fluctuations and not due to actual

downsizing. In such a case the NBFC shall

continue to meet the reporting requirements

and shall comply with the extant directions as

applicable to NBFC-ML, till the submission of

its next audited balance sheet to the Reserve

Bank and a specific dispensation from the

Reserve Bank in this regard.

1

Master Direction - Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking Company (Reserve Bank)

Directions, 2016 (Updated as on August 29, 2023)

Master Direction - Non-Banking Financial Company - Systemically Important Non-Deposit taking Company and Deposit taking Company

(Reserve Bank) Directions, 2016 (Updated as on August 29, 2023)

Scale Based Regulation (SBR): A Revised Regulatory Framework for NBFCs and related circulars (Note: certain provisions of the SBR

framework and its circular are not consolidated and continue to apply as directed by RBI)

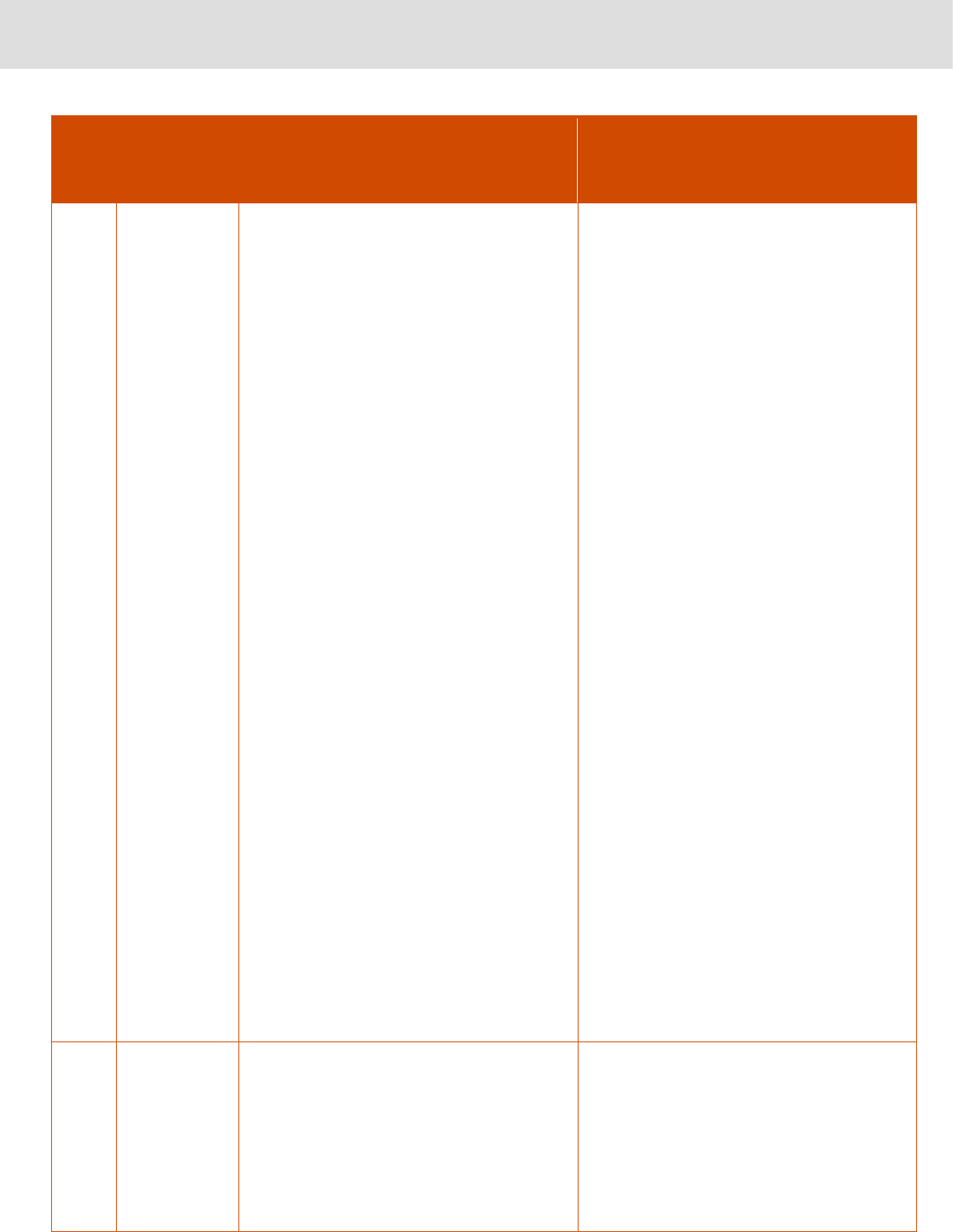

3 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

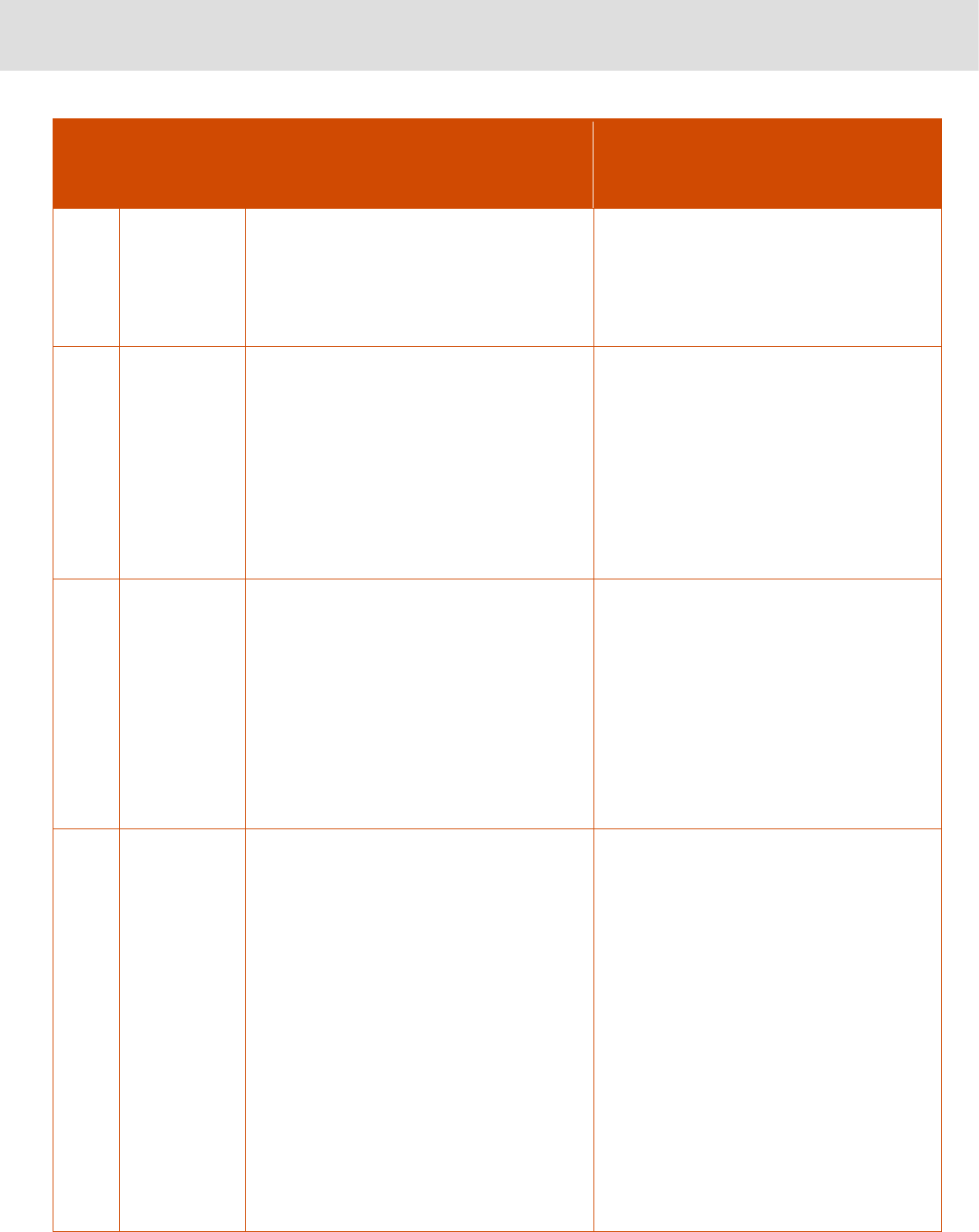

3.

Applicability as

per categories

of NBFCs

-

Section I – Introduction: Para 3

3.1 The provisions of these Directions shall

apply to the following:

3.1.1 Every NBFC-D registered with the

Reserve Bank under the provisions of the RBI

Act, 1934;

3.1.2 Every NBFC-ICC registered with the

Reserve Bank under the provisions of the RBI

Act, 1934;

3.1.3 Every NBFC-Factor registered with the

Reserve Bank under section 3 of the

Factoring Regulation Act, 2011 and every

NBFC-ICC registered with the Reserve Bank

under section 3 of the Factoring Regulation

Act, 2011;

3.1.4 Every NBFC-MFI registered with the

Reserve Bank under the provisions of the RBI

Act, 1934;

3.1.5 Every NBFC-IFC registered with the

Reserve Bank under the provisions of the RBI

Act, 1934;

3.1.6 Every IDF-NBFC registered with the

Reserve Bank under the provisions of the RBI

Act, 1934.

3.2 These Directions shall apply to an NBFC

being a Government company as defined

under clause (45) of section 2 of the

Companies Act, 2013 (Act 18 of 2013).

3.3 Specific directions applicable to specific

categories of NBFCs registered as NBFC-

Factor and NBFC-ICC registered under

Factoring Regulation Act, 2011, IDFNBFC

and NBFC-MFI are as provided under

respective Sections in these Directions.

Instructions contained for specific categories

of NBFCs in respective Sections are in

addition and not in substitution to the relevant

instructions contained in these Directions.

3.4 The Directions under Chapter IV, Chapter

V, paragraphs 4.1.1, 45, 66 and 67 shall not

4 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

apply to NBFCs not availing public funds and

not having any customer interface.

3.5 NBFCs availing public funds but not

having any customer interface are exempt

from the applicability of paragraphs 4.1.1, 45,

66 and 67 of the Directions.

3.6. NBFCs-BL having customer interface but

not availing public funds are exempt from the

applicability of Chapter IV and Chapter V of

the Directions.

4.

Applicability of

other Directions

issued by the

Department of

Regulations

-

Section I – Introduction Para 4

4.1 NBFCs shall ensure compliance with the

applicable instructions, as prescribed in the

following Directions:

4.1.1 Master Direction - Know Your Customer

(KYC) Direction, 2016, as amended from time

to time.

4.1.2 Master Direction – Reserve Bank of

India (Transfer of Loan Exposures)

Directions, 2021, as amended from time to

time.

4.1.3 Master Direction – Reserve Bank of

India (Securitisation of Standard Assets)

Directions, 2021, as amended from time to

time.

4.1.4 Master Direction – Reserve Bank of

India (Regulatory Framework for Microfinance

Loans) Directions, 2022, as amended from

time to time.

4.1.5 Master Direction – Credit Card and

Debit Card – Issuance and Conduct

Directions, 2022, as amended from time to

time.

4.2 These Directions consolidate the

regulations as issued by Department of

Regulation of the Reserve Bank. Any other

directions/guidelines issued by any other

Department of the Reserve Bank, as

applicable to an NBFC shall be adhered to.

4.3 The categories of NBFCs, mentioned

below, shall be subject to extant regulations

governing them, as under:

5 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

4.3.1 NBFC-P2P - Master Directions - Non-

Banking Financial Company – Peer to Peer

Lending Platform (Reserve Bank) Directions,

2017, as amended from time to time.

4.3.2 NBFC-AA - Master Direction- Non-

Banking Financial Company – Account

Aggregator (Reserve Bank) Directions, 2016,

as amended from time to time.

4.3.3 CIC - Master Direction - Core

Investment Companies (Reserve Bank)

Directions, 2016, as amended from time to

time.

4.3.4 SPD - Master Direction - Standalone

Primary Dealers (Reserve Bank) Directions,

2016, as amended from time to time.

4.3.5 MGC - Master Directions - Mortgage

Guarantee Companies (Reserve Bank)

Directions, 2016 , as amended from time to

time.

4.3.6 HFC - Master Direction – Non-Banking

Financial Company – Housing Finance

Company (Reserve Bank) Directions, 2021,

as amended from time to time.

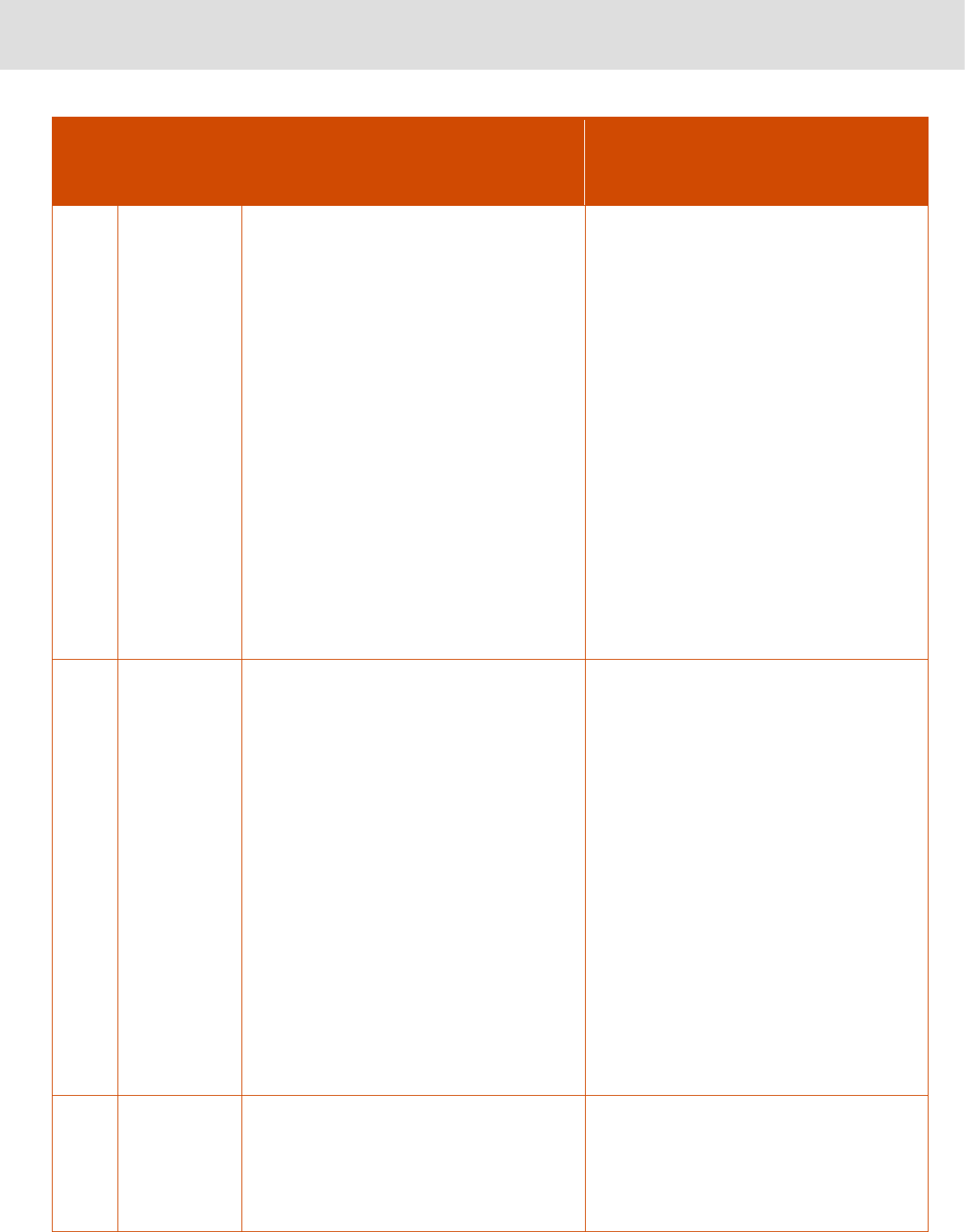

5.

Definition of

NBFC-IFC

“NBFC-IFC” means a non-deposit taking

NBFC that fulfills the following criteria:

(a) a minimum of 75 per cent of its total

assets deployed in “infrastructure loans”;

(b) Net owned funds of ₹300 crore or above;

(c) minimum credit rating of 'A' issued by any

of the SEBI-registered Credit Rating

Agencies;

(d) CRAR of 15 percent (with a minimum Tier

I capital of 10 percent).

Section I – Introduction

Para 5.1.20: “NBFC-IFC” means a non-

deposit taking NBFC which has a minimum of

75 percent of its total assets deployed

towards infrastructure lending.

6.

Definition of

NBFC-MFI

“NBFC-MFI” means a non-deposit taking

NBFC that fulfils the following conditions: (a)

Minimum Net Owned Funds of ₹5 crore. (For

NBFC-MFIs registered in the North-Eastern

Region of the country, the minimum NOF

requirement shall stand at ₹2 crore). (b) Not

less than 75% of its total assets are in the

nature of “microfinance loans” as defined

Section I – Introduction

Para 5.1.21: “NBFC-MFI” means a non-

deposit taking NBFC which has a minimum of

75 percent of its total assets deployed

towards “microfinance loans” as defined

under Reserve Bank of India (Regulatory

6 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

under Reserve Bank of India (Regulatory

Framework for Microfinance Loans)

Directions, 2022.

Framework for Microfinance Loans)

Directions, 2022.

7.

Definition of

Tier-I Capital

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

“Tier I Capital” means owned fund as reduced

by investment in shares of other non-banking

financial companies and in shares,

debentures, bonds, outstanding loans and

advances including hire purchase and lease

finance made to and deposits with

subsidiaries and companies in the same

group exceeding, in aggregate, ten per cent

of the owned fund;

Provision applicable to NBFC-ND-SI asset

size above 500 crore

“Tier I Capital” means owned fund as reduced

by investment in shares of other non-banking

financial companies and in shares,

debentures, bonds, outstanding loans and

advances including hire purchase and lease

finance made to and deposits with

subsidiaries and companies in the same

group exceeding, in aggregate, ten per cent

of the owned fund; and perpetual debt

instruments issued by a non-deposit taking

non-banking financial company in each year

to the extent it does not exceed 15 per cent of

the aggregate Tier I Capital of such company

as on March 31 of the previous accounting

year.

Section I – Introduction

Para 5.1.34: “Tier 1 capital” for NBFCs

(except NBFCs-BL) is the sum of

(i) Owned fund as reduced by investment in

shares of other NBFCs and in shares,

debentures, bonds, outstanding loans and

advances including hire purchase and lease

finance made to and deposits with

subsidiaries and companies in the same

group exceeding, in aggregate, ten percent of

the owned fund; and

(ii) Perpetual debt instruments issued by a

non-deposit taking NBFCs in each year to the

extent it does not exceed 15 percent of the

aggregate Tier 1 capital of such company as

on March 31 of the previous accounting year.

Note – NBFCs-BL are not eligible to include

perpetual debt instruments in their Tier 1

capital.

8.

Definition of

Tier-II Capital

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

“Tier II capital” includes the following:

i. preference shares other than those which

are compulsorily convertible into equity;

ii. revaluation reserves at discounted rate of

fifty five percent;

iii. General provisions (including that for

Standard Assets) and loss reserves to the

extent these are not attributable to actual

Section I – Introduction

Para 5.1.35:“Tier 2 capital” for NBFCs

(except NBFCs-BL) is the sum of

i. Preference shares other than those which

are compulsorily convertible into equity;

ii. Revaluation reserves at discounted rate of

55 percent;

iii. General provisions (including that for

Standard Assets) and loss reserves to the

extent these are not attributable to actual

7 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

diminution in value or identifiable potential

loss in any specific asset and are available

to meet unexpected losses, to the extent

of one and one fourth percent of risk

weighted assets;

iv. hybrid debt capital instruments;

v. subordinated debt;

and to the extent the aggregate does not

exceed Tier I capital.

Provision applicable to NBFC-ND-SI asset

size above 500 crore

“Tier II capital” includes the following:

(a) preference shares other than those which

are compulsorily convertible into equity;

(b) revaluation reserves at discounted rate of

fifty five per cent;

(c) General provisions (including that for

Standard Assets) and loss reserves to the

extent these are not attributable to actual

diminution in value or identifiable potential

loss in any specific asset and are available to

meet unexpected losses, to the extent of one

and one fourth percent of risk weighted

assets;

(d) hybrid debt capital instruments;

(e) subordinated debt; and

(f) perpetual debt instruments issued by a

non-deposit taking non-banking financial

company which is in excess of what qualifies

for Tier I Capital, to the extent the aggregate

does not exceed Tier I capital.

diminution in value or identifiable potential

loss in any specific asset and are available

to meet unexpected losses, to the extent

of one and one fourth percent of risk

weighted assets;

iv. Hybrid debt capital instruments;

v. Subordinated debt; and

vi. Perpetual debt instruments issued by a

non-deposit taking NBFC which is in

excess of what qualifies for Tier 1 capital;

to the extent the aggregate does not exceed

Tier 1 capital.

Note – NBFCs-BL are not eligible to include

perpetual debt instruments in their Tier 2

capital.

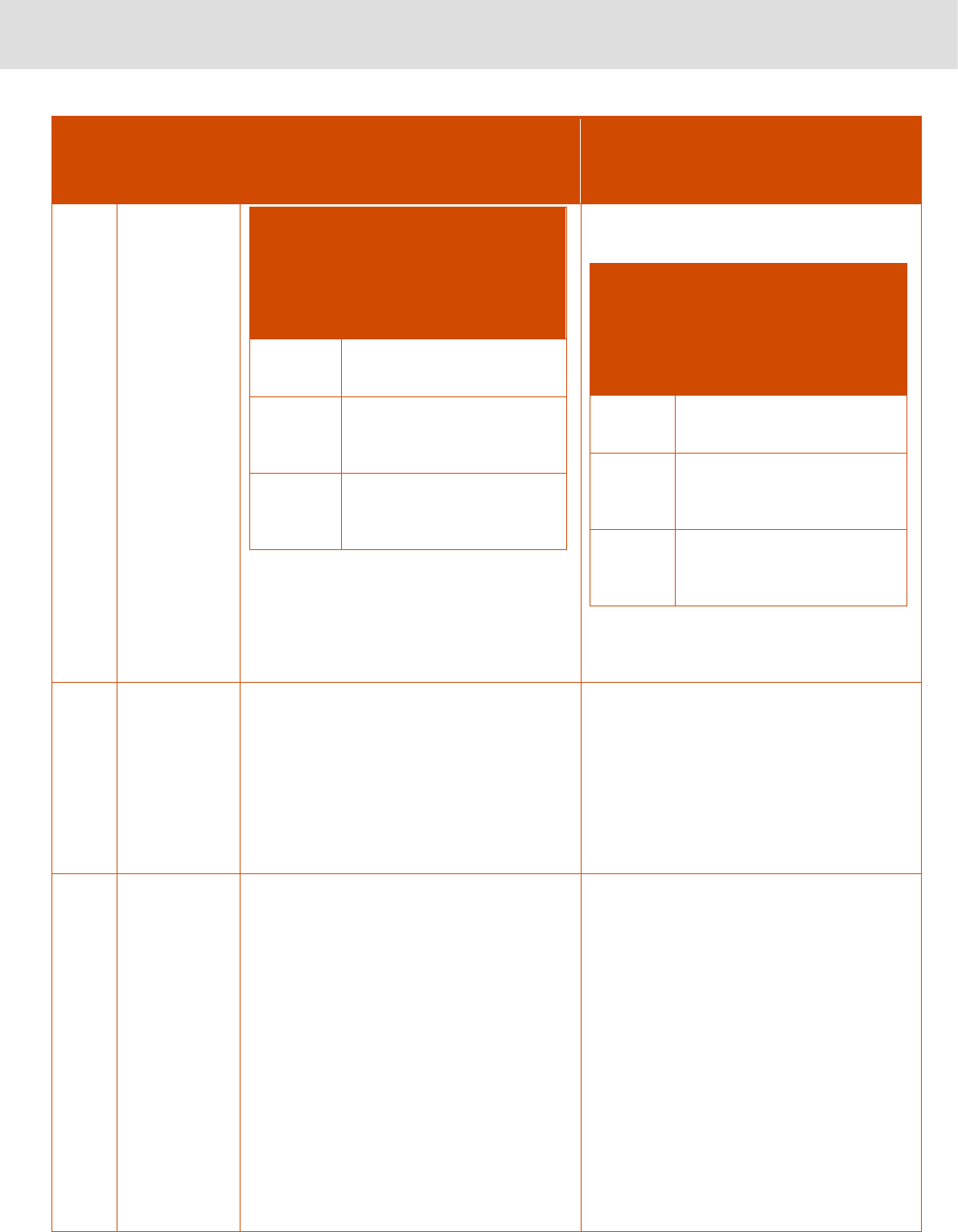

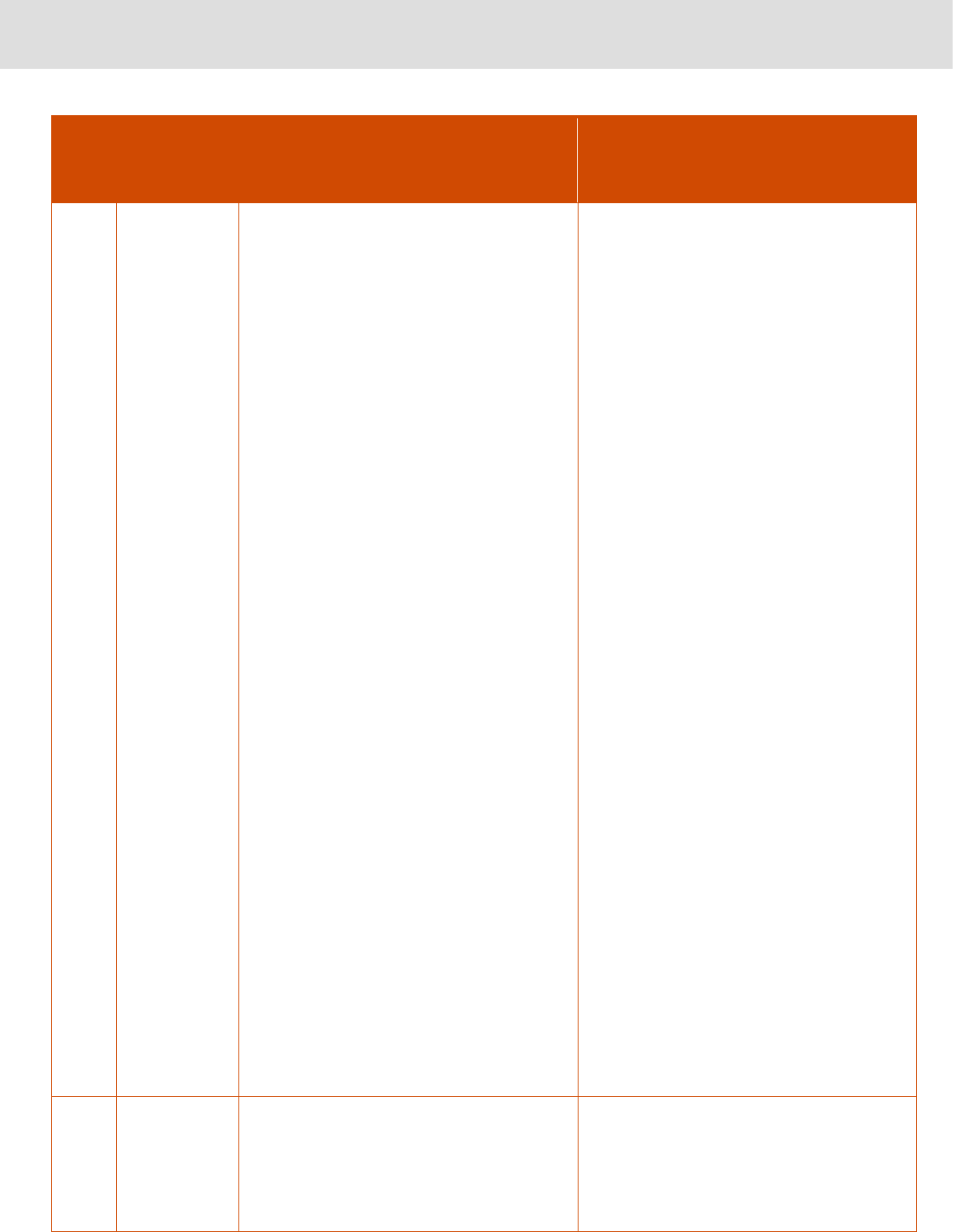

9.

Net Owned

Fund

Requirements

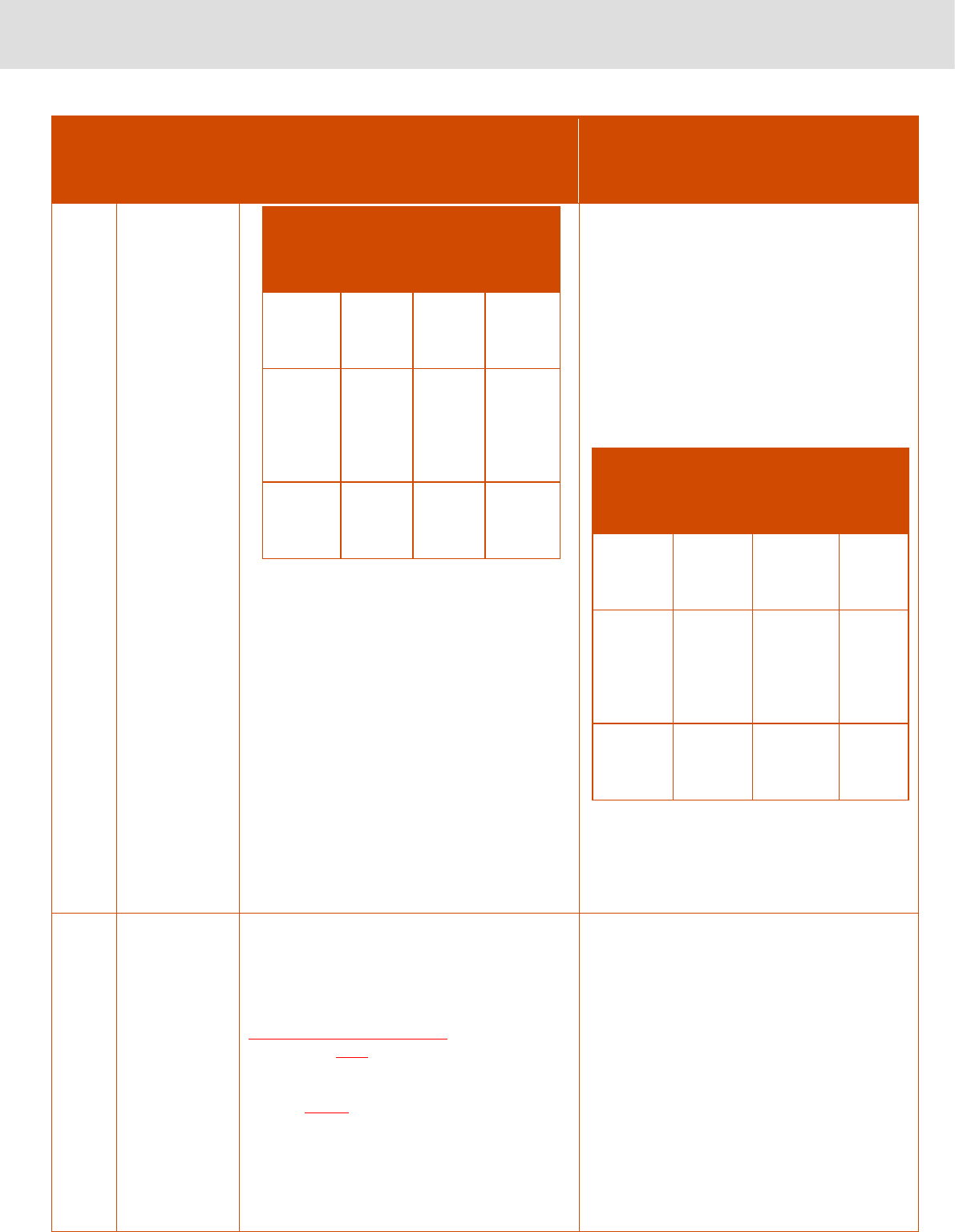

Para 3.1 (a) of SBR Framework

Regulatory minimum Net Owned Fund (NOF)

for NBFC-ICC, NBFC-MFI and NBFC-Factors

shall be increased to ₹10 crore. The following

glide path is provided for the existing NBFCs

to achieve the NOF of ₹10 crore:

Section II – Regulations applicable for

NBFCs – BL

Para 6: Net Owned Fund Requirement

6.1 In exercise of the powers conferred under

clause (b) of sub-section (1) of section 45IA

of the RBI Act,1934 and all the powers

enabling it in that behalf, the Reserve Bank,

hereby specifies ₹10 crore as the Net Owned

Fund (NOF) required for an NBFC-ICC,

8 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

NBFCs

Current

NOF

By

March

31, 2025

By

March

31, 2027

NBFC-

ICC

₹2 crore

₹5 crore

₹10

crore

NBFC-

MFI

₹5 crore

(₹2 crore

in NE

Region)

₹7 crore

(₹5 crore

in NE

Region)

₹10

crore

NBFC-

Factors

₹5 crore

₹7 crore

₹10

crore

However, for NBFC-P2P, NBFC-AA, and

NBFCs with no public funds and no customer

interface, the NOF shall continue to be ₹2

crore. It is clarified that there is no change in

the existing regulatory minimum NOF for

NBFCs - IDF, IFC, MGCs, HFC, and SPD.

NBFC-MFI and NBFC-Factor to commence

or carry on the business of non-banking

financial institution. For NBFC-P2P, NBFC-

AA, and NBFC not availing public funds and

not having any customer interface, the NOF

shall be ₹2 crore. For NBFC-IFC and IDF-

NBFC, the NOF shall be ₹300 crore.

6.2 The following glide path is provided for

the existing NBFCs, viz., NBFC-ICC, NBFC-

MFI and NBFC-Factor to achieve the NOF of

₹10 crore:

NBFCs

Current

NOF

By March

31, 2025

By

March

31, 2027

NBFC-

ICC

₹2 crore

₹5 crore

₹10

crore

NBFC-

MFI

₹5 crore

(₹2 crore

in NE

Region)

₹7 crore

(₹5 crore

in NE

Region)

₹10

crore

NBFC-

Factors

₹5 crore

₹7 crore

₹10

crore

6.3 NBFCs failing to achieve the prescribed

level within the stipulated period shall not be

eligible to hold the Certificate of Registration

(CoR) as NBFCs.

10.

Investment

through

Alternative

Investment

Funds -

Calculation of

NOF of an

NBFC

While arriving at the NOF figure, investment

made by an applicable NBFC in entities of the

same group concerns shall be treated alike,

whether the investment is made directly or

through an Alternative Investment Fund (AIF)/

Venture Capital Fund (VCF), and when the

funds in the VCF have come from the

applicable NBFC to the extent of 50per cent

or more; or where the beneficial owner, in the

case of Trusts is the applicable NBFC, if 50

per cent of the funds in the Trusts are from

the concerned applicable NBFC. For this

purpose, "beneficial ownership" shall mean

holding the power to make or influence

decisions in the Trust and being the recipient

of benefits arising out of the activities of the

Section II – Regulations applicable for

NBFCs – BL

Para 7: In terms of section 45IA of the RBI

Act, 1934, the investments/loans/exposures

to the subsidiaries, companies in the same

group and other NBFCs, in excess of 10 per

cent of aggregate of the paid-up equity capital

and free reserves are deducted to arrive at

NOF. In the context of arriving at the NOF

figure, investment made by the NBFC in

entities of the same group, either directly or

indirectly, through an Alternative Investment

Fund (AIF), shall be treated alike, provided

the funds in the AIF (in company form) have

come from NBFC to the extent of 50 per cent

9 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

Trust. In arriving at the NOF, the substance

would take precedence over form.

or more; or where the beneficial owner in the

case of AIF (in trust form) is the NBFC and 50

per cent of the funds in the trust have come

from the NBFC. For this purpose, "beneficial

ownership" shall mean holding the power to

make or influence decisions in the trust and

being the recipient of benefits arising out of

the activities of the trust. In arriving at the

NOF, the substance would take precedence

over form.

11.

Leverage ratio

and Tier 1

Capital

Applicable only to the NBFC-ND-NSI

(asset size below 500 crore):

The leverage ratio of an applicable NBFC

(except NBFC-MFIs and NBFC-IFCs) shall

not be more than 7 at any point of time, with

effect from March 31, 2015.

In respect of NBFCs primarily engaged in

lending against gold jewellery (such loans

comprising 50 percent of more of their

financial assets) they shall maintain a

minimum Tier I capital of 12 per cent.

Section II – Regulations applicable for

NBFCs – BL asset size upto 1000 crore

Para 9.1

Leverage Ratio- The leverage ratio of

NBFCs (except NBFC-MFIs, NBFCs-ML and

above) shall not be more than seven at any

point of time.

Note: Leverage ratio means the total Outside

Liabilities divided by Owned Fund.

Para 9.2

Tier I capital - NBFCs primarily engaged in

lending against gold jewellery (such loans

comprising 50 percent of more of their

financial assets) shall maintain a minimum

Tier 1 capital of 12 percent of aggregate risk

weighted assets of on-balance sheet and of

risk adjusted value of off-balance sheet items.

The treatment to on-balance and off-balance

sheet assets for capital adequacy shall be as

provided in paragraphs 84 and 85 of these

Directions respectively. These NBFCs shall

also adhere to provisions in paragraph 86 of

the Directions on treatment of deferred tax

assets and deferred tax liabilities for

computation of capital

12.

Income

Recognition

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

In cases of loans where moratorium has been

granted for repayment of interest, the interest

income may be recognised on accrual basis

for accounts which continue to be classified

as ‘standard’.

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

Para 12.3 -

In cases of loans where moratorium has been

granted for repayment of interest, the interest

income may be recognised on accrual basis

for accounts which continue to be classified

10 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

Provision applicable to NBFC-ND-SI asset

size above 500 crore

In cases of loans where moratorium has been

granted for repayment of interest, the interest

income may be recognised on accrual basis

for accounts which continue to be classified

as ‘standard’. This shall be evaluated against

the definition of ‘restructuring’ provided in

paragraph 1 of the Annex-1 to the circular

regarding ‘Prudential Framework for

Resolution of Stressed Assets’ dated June 7,

2019.

as ‘standard’. For NBFCs-ML and NBFCs-UL,

this shall be evaluated against the definition

of ‘restructuring’ provided in paragraph 1 of

the Annex-1 to the circular on ‘Prudential

Framework for Resolution of Stressed Assets’

dated June 7, 2019.

13.

Asset

Classification

The asset classification norms as given below

shall apply to every applicable NBFC (except

NBFC-MFIs).

Section II – Regulations applicable for

NBFCs – BL

Para 14

The asset classification norms as given below

shall apply to ‘applicable’ NBFCs (i.e. except

NBFCs-ML and above and microfinance

loans of NBFC-MFIs).

14.

Sub-standard

asset

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

Sub-standard Asset- (a) an asset which has

been classified as non-performing asset for a

period not exceeding 18 months;………..

Provision applicable to NBFC-ND-SI asset

size above 500 crore

Sub-standrad Asset - (a) an asset which has

been classified as non-performing asset for a

period not exceeding 12 months……….

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

Para 14.1.2. -

“Sub-standard asset” shall mean

(i) an asset which has been classified as non-

performing asset for a period not exceeding

18 months;…………

Section III – Regulations applicable for

NBFCs – ML (asset size 1000 crore and

above)

Para 87-

“Sub-standard asset” shall mean- (i) an asset

which has been classified as non-performing

asset for a period not exceeding 12

months;……………

11 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

15.

Doubtful asset

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

Doubtful asset - shall mean: a. a term loan, or

b. a lease asset, or c. a hire purchase asset,

or d. any other asset, which remains a sub-

standard asset for a period exceeding 18

months;

Provision applicable to NBFC-ND-SI asset

size above 500 crore

Doubtful asset shall mean -(a) a term loan, or

(b) a lease asset, or (c) a hire purchase

asset, or (d) any other asset, which remains a

sub-standard asset for a period exceeding 12

months.

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

Para 14.1.3-

“Doubtful asset” shall mean

(i) a term loan, or

(ii) a lease asset, or

(iii) a hire purchase asset, or

(iv) any other asset,

which remains a sub-standard asset for a

period exceeding 18 months.

Section III – Regulations applicable for

NBFCs – ML (asset size 1000 crore and

above)

Para 87-

“Doubtful asset” shall mean:

(i) a term loan, or

(ii) a lease asset, or

(iii) a hire purchase asset, or

(iv) any other asset,

which remains a sub-standard asset for a

period exceeding 12 months

16.

Non-

Performing

Asset

(v) Non-Performing Asset (referred to in these

Directions as “NPA”) shall mean: (NBFC-ND-

NSI asset size below 500 crore)

a) an asset, in respect of which, interest has

remained overdue for a period of six months

or more;

b) a term loan inclusive of unpaid interest,

when the instalment is overdue for a period of

six months or more or on which interest

amount remained overdue for a period of six

months or more;

Section II – Regulations applicable for

NBFCs – BL asset size upto 1000 crore

Para 14.3

“Non-Performing Asset” (NPA) for applicable

NBFCs shall mean:

(i) an asset, in respect of which, interest has

remained overdue for a period of more than

180 days.

(ii) a term loan inclusive of unpaid interest,

when the instalment is overdue for a period of

more than 180 days or on which interest

12 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

c) a demand or call loan, which remained

overdue for a period of six months or more

from the date of demand or call or on which

interest amount remained overdue for a

period of six months or more;

d) a bill which remains overdue for a period of

six months or more;

e) the interest in respect of a debt or the

income on receivables under the head 'other

current assets' in the nature of short term

loans / advances, which facility remained

overdue for a period of six months or more;

f) any dues on account of sale of assets or

services rendered or reimbursement of

expenses incurred, which remained overdue

for a period of six months or more;

g) the lease rental and hire purchase

instalment, which has become overdue for a

period of twelve months or more;

h) in respect of loans, advances and other

credit facilities (including bills purchased and

discounted), the balance outstanding under

the credit facilities (including accrued interest)

made available to the same borrower /

beneficiary when any of the above credit

facilities becomes non-performing asset;

Provided that in the case of lease and hire

purchase transactions, an applicable NBFC

shall classify each such account on the basis

of its record of recovery.

amount remained overdue for a period of

more than 180 days.

(iii) a demand or call loan, which remained

overdue for a period of more than 180 days

from the date of demand or call or on which

interest amount remained overdue for a

period of more than 180 days.

(iv) a bill which remains overdue for a period

of more than 180 days.

(v) the interest in respect of a debt or the

income on receivables under the head 'other

current assets' in the nature of short-term

loans/advances, which facility remained

overdue for a period of more than 180 days

(vi) any dues on account of sale of assets or

services rendered or reimbursement of

expenses incurred, which remained overdue

for a period of more than 180 days.

(vii) the lease rental and hire purchase

instalment, which has become overdue for a

period of more than 180 days.

(viii) in respect of loans, advances and other

credit facilities (including bills purchased and

discounted), the balance outstanding under

the credit facilities (including accrued interest)

made available to the same borrower/

beneficiary when any of the above credit

facilities becomes non-performing asset.

Provided that in the case of lease and hire

purchase transactions, an applicable NBFC

shall classify each such account on the basis

of its record of recovery.

Note: The period of more than 180 days for

NPA classification as mentioned above shall

be adjusted as per glide path outlined in

paragraph 14.2.

17.

Non-

Performing

Asset (SMA

Classification)

Applicable to NBFC-ND-NSI asset size

below 500 crore

Every NBFC shall recognise incipient stress

in loan accounts, immediately on default, by

classifying such assets as special mention

accounts (SMA) as per the following

categories:

Section II – Regulations applicable for

NBFCs – BL asset size upto 1000 crore

Para 14.4.2

Every NBFC shall recognise incipient stress

in loan accounts, immediately on default, by

classifying such assets as special mention

13 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

SMA

Subcate

gories

Basis for classification -

Principal or interest

payment or any other

amount wholly or partly

overdue

SMA – 0

Upto 30 days

SMA – 1

More than 30 days and upto

60 days

SMA – 2

More than 60 days and upto

180 days

accounts (SMA) as per the following

categories:

SMA

Subcat

egories

Basis for classification

- Principal or interest

payment or any other

amount wholly or

partly overdue

SMA – 0

Upto 30 days

SMA – 1

More than 30 days and upto

60 days

SMA – 2

More than 60 days and upto

180 days

Note: The period of SMA-2 shall be adjusted

as per glide path outlined in paragraph 14.2.

18.

Provisioning

Requirements

The provisioning requirements as given

below shall apply to every applicable NBFC

(except NBFC-MFIs)

Section II – Regulations applicable for

NBFCs – BL

Para 15

The provisioning requirements as given

below shall apply to every NBFC (except

microfinance loans of NBFC-MFIs).

19.

Standard

Asset

Provisioning

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

Every applicable NBFC shall make provision

for standard assets at 0.25 per cent of the

outstanding, which shall not be reckoned for

arriving at net NPAs. The provision towards

standard assets need not be netted from

gross advances but shall be shown

separately as 'Contingent Provisions against

Standard Assets' in the balance sheet.

Provision applicable to NBFC-ND-SI asset

size above 500 crore

Every applicable NBFC shall make provisions

for standard assets at 0.40 per cent by the

end of March 2018 and thereafter, of the

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

Para 16

Standard asset provisioning (except NBFC-

ML and above)

NBFC-BL shall make provision for standard

assets at 0.25 percent of the outstanding,

which shall not be reckoned for arriving at net

NPAs. The provision towards standard assets

need not be netted from gross advances but

shall be shown separately as 'Contingent

Provisions against Standard Assets' in the

balance sheet.

14 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

outstanding, which shall not be reckoned for

arriving at net NPAs. The provision towards

standard assets need not be netted from

gross advances but shall be shown

separately as ‘Contingent Provisions against

Standard Assets’ in the balance sheet.

20.

Non-

Cooperative

Borrowers

Provisions applicable to all the NBFCs

irrespective of their asset size.

All Notified NBFCs shall identify "non-co-

operative borrowers".

Section II – Regulations applicable for

NBFCs – BL

Para 21

All NBFC-Factors, NBFCs-D and non-deposit

taking NBFCs of asset size of ₹500 crore and

above (Notified NBFCs) shall identify "non-

cooperative borrowers"

21.

Early

Recognition of

Financial

Distress,

Prompt Steps

for Resolution

and Fair

Recovery for

Lenders:

Framework for

Revitalizing

Distressed

Assets in the

Economy

Framework for Revitalizing Distressed Assets

in the Economy (Framework) as provided for

in Annex XVIII shall apply to all NBFC-

Factors.

Section II – Regulations applicable for

NBFCs – BL

Para 25 -Framework for Revitalizing

Distressed Assets in the Economy

(Framework) as provided in Annex IV shall

apply to non-deposit taking NBFCs with asset

size less than ₹500 crore.

22.

Credit/investm

ent

concentration

norms for

NBFCs

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

Concentration of credit/ investment for

applicable NBFC

(1) An applicable NBFC which is held by an

NOFHC shall not

(i) have any exposure (credit and investments

including investments in the equity/ debt

capital instruments) to the Promoters/

Promoter Group entities or individuals

associated with the Promoter Group or the

NOFHC;

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

Para 32

An NBFC which is held by an NOFHC shall

not

(i) have any exposure (credit and investments

including investments in the equity/debt

capital instruments) to the

Promoters/Promoter Group entities or

individuals associated with the Promoter

Group or the NOFHC;

(ii) make investment in the equity/debt capital

instruments in any of the financial entities

under the NOFHC;

15 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

(ii) make investment in the equity/ debt capital

instruments in any of the financial entities

under the NOFHC;

(iii) invest in equity instruments of other

NOFHCs.

Explanation: For the purposes of this

paragraph, the expression, 'Promoter' and

'Promoter Group' shall have the meanings

assigned to those expressions in the

"Guidelines for Licensing of New Banks in the

Private Sector" issued by the Bank - Annex V.

(iii) invest in equity instruments of other

NOFHCs.

Explanation: For the purposes of this

paragraph, the expression, 'Promoter' and

'Promoter Group' shall have the meanings

assigned to those expressions in Annex I of

"Guidelines for Licensing of New Banks in the

Private Sector" dated February 22, 2013,

issued by the Reserve Bank.

23.

Declaration of

dividends

Provisions applicable to NBFC-ND-SI

asset size above 500 crore

NBFCs shall comply with the following

guidelines to declare dividends.

(1) The Board of Directors, while considering

the proposals for………..

…………(5)……………….. The Reserve

Bank shall not entertain any request for ad-

hoc dispensation on declaration of dividend.

(6) NBFCs declaring dividend shall report

details of dividend declared during the

financial year as per the format prescribed in

Annex IX. The report shall be furnished within

a fortnight after declaration of dividend to the

Regional Office of the Department of

Supervision of the Reserve Bank.

Section II – Regulations applicable for

NBFCs – BL

Para 3 3

NBFCs shall comply with the following

guidelines to declare dividends.

33.1 The Board of Directors, while

considering the proposals for dividend, shall

take into account each of the following

aspects:………………………….33.5

…………………The Reserve Bank shall not

entertain any request for ad-hoc dispensation

on declaration of dividend.

33.6 NBFCs, other than NBFCs-BL,

declaring dividend shall report details of

dividend declared during the financial year as

per the format prescribed in Annex IX. The

report shall be furnished within a fortnight

after declaration of dividend to the Regional

Office of the Department of Supervision of the

Reserve Bank.

24.

Fair Practices

Code

NBFCs having customer interface shall adopt

the following guidelines:

Section II – Regulations applicable for

NBFCs – BL

Para 45 -

NBFCs having customer interface shall adopt

the following guidelines:

For the purpose of this paragraph, the term

‘personal loans’ shall have the same meaning

as defined in the Annex to the circular on

16 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

‘XBRL Returns – Harmonization of Banking

Statistics’ dated January 04, 2018.

25.

Appointment of

Non-Deposit

Accepting

NBFCs as sub-

agents under

Money

Transfer

Service

Schemes

(MTSS)

Applicable NBFCs may act as sub-agents

under MTSS without any prior approval of the

Bank.

Section II – Regulations applicable for

NBFCs – BL

Para 62

NBFCs may act as sub-agents under MTSS

without any prior approval of the Reserve

Bank. Deposit accepting NBFCs shall not

undertake such activity.

26.

Undertaking of

Point of

Presence

Services under

Pension Fund

Regulatory and

Development

Authority for

National

Pension

System

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

Applicable NBFCs shall not undertake Point

of Presence (PoP) services for National

Pension System (NPS) under Pension Fund

Regulatory and Development Authority.

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

NBFC-BL shall not undertake Point of

Presence (PoP) services for National Pension

System (NPS) under Pension Fund

Regulatory and Development Authority.

27.

Filing of

records of

mortgages with

the Central

Registry

Applicable NBFCs shall file and register the

records of equitable mortgages created in

their favour on or after March 31, 2011 with

the Central Registry of Securitisation Asset

Reconstruction and Security Interest of India

(CERSAI) and shall also register the records

with the Central Registry as and when

equitable mortgages are created in their

favour. Applicable NBFCs shall register all

types of mortgages with CERSAI.

Section II – Regulations applicable for

NBFCs – BL

Para 68 - NBFCs shall file and register the

records of equitable mortgages created in

their favour on or after March 31, 2011 with

the Central Registry of Securitisation Asset

Reconstruction and Security Interest of India

(Central Registry) and shall also register the

records with the Central Registry as and

when equitable mortgages are created in

their favour. NBFCs shall register all types of

mortgages with Central Registry and adhere

to the provisions contained in the circular

‘Filing of Security Interest relating to

Immovable (other than equitable mortgage),

Movable and Intangible Assets in CERSAI’

dated December 27, 2018, as amended from

time to time.

17 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

28.

Migration of

Post-Dated

Cheques

(PDCs)/

Equated

Monthly

Instalment

(EMI) Cheques

to National

Automated

Clearing

House(NACH)(

Debit)

Considering the protection available under

section 25 of the Payment and Settlement

Systems Act, 2007 which accords the same

rights and remedies to the payee

(beneficiary) against dishonour of electronic

funds transfer instructions on grounds of

insufficiency of funds as are available under

section 138 of the Negotiable Instruments

Act, 1881, there shall be no need for

applicable NBFCs to take additional cheques,

if any, from customers in addition to ECS

(Debit) mandates. Cheques complying with

CTS-2010 standard formats shall alone be

obtained in locations, where the facility of

ECS/ RECS is not available.

Section II – Regulations applicable for

NBFCs – BL

Para 76

Considering the protection available under

section 25 of the Payment and Settlement

Systems Act, 2007 which accords the same

rights and remedies to the payee

(beneficiary) against dishonour of electronic

funds transfer instructions on grounds of

insufficiency of funds as are available under

section 138 of the Negotiable Instruments

Act, 1881, there shall be no need for NBFCs

to take additional cheques, if any, from

customers in addition to NACH (Debit)

mandates. Accordingly, NBFCs have been

advised not to accept fresh/ additional PDCs

or EMI cheques from their customers.

Cheques complying with CTS-2010 standard

formats alone shall be obtained in locations,

where the facility of NACH is not available.

29.

Capital

Requirement

(1) Every applicable NBFC shall maintain a

minimum capital ratio consisting of Tier I and

Tier II capital which shall not be less than 15

per cent of its aggregate risk weighted assets

on-balance sheet and of risk adjusted value

of off-balance sheet items.

(2) The Tier I capital in respect of applicable

NBFCs (other than NBFC-MFI), at any point

of time, shall not be less than 10 per cent.

(3) Applicable NBFCs primarily engaged in

lending against gold jewellery (such loans

comprising 50 per cent or more of their

financial assets) shall maintain a minimum

Tier l capital of 12 per cent.

Section III – Regulations applicable for

NBFCs – ML

Para 81

81.1 NBFCs shall maintain a minimum capital

ratio consisting of Tier 1 and Tier 2 capital

which shall not be less than 15 percent of its

aggregate risk weighted assets on balance

sheet and of risk adjusted value of off-

balance sheet items.

81.2 Tier 1 capital in respect of NBFC (except

NBFC-MFI and NBFC primarily engaged in

lending against gold jewellery), at any point of

time, shall not be less than 10 percent. i.e. for

NBFCs with such loans comprising 50

percent of more of their financial assets, Tier I

capital shall be minimum of 12% as

prescribed in paragraph 9.2 of these

Directions.

30.

Non-

Performing

Asset

Provisions applicable to NBFC-ND-SI

asset size above 500 crore

(v) Non-Performing Asset (referred to in these

Directions as “NPA”) shall mean:

Section III – Regulations applicable for

NBFCs – ML asset size 1000 crore and

above

Para 87.1.5

18 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

(a) an asset, in respect of which, interest has

remained overdue for a period of three

months or more;

(b) a term loan inclusive of unpaid interest,

when the instalment is overdue for a period of

three months or more or on which interest

amount remained overdue for a period of

three months or more;

(c) a demand or call loan, which remained

overdue for a period of three months or more

from the date of demand or call or on which

interest amount remained overdue for a

period of three months or more;

(d) a bill which remains overdue for a period

of three months or more;

(e) the interest in respect of a debt or the

income on receivables under the head ‘other

current assets’ in the nature of short term

loans/ advances, which facility remained

overdue for a period of three months or more;

(f) any dues on account of sale of assets or

services rendered or reimbursement of

expenses incurred, which remained overdue

for a period of three months or more;

(g) the lease rental and hire purchase

instalment, which has become overdue for a

period of three months or more;

(h) in respect of loans, advances and other

credit facilities (including bills purchased and

discounted), the balance outstanding under

the credit facilities (including accrued interest)

made available to the same borrower/

beneficiary when any of the above credit

facilities becomes non-performing asset:

Provided that in the case of lease and hire

purchase transactions, an applicable NBFC

shall classify each such account on the basis

of its record of recover

(i) an asset, in respect of which, interest has

remained overdue for a period of more than

90 days.

(ii) a term loan inclusive of unpaid interest,

when the instalment is overdue for a period of

more than 90 days or on which interest

amount remained overdue for a period of

more than 90 days.

(iii) a demand or call loan, which remained

overdue for a period of more than 90 days

from the date of demand or call or on which

interest amount remained overdue for a

period of more than 90 days

(iv) a bill which remains overdue for a period

of more than 90 days.

(v) the interest in respect of a debt or the

income on receivables under the head 'other

current assets' in the nature of short-term

loans/advances, which facility remained

overdue for a period of more than 90 days.

(vi) any dues on account of sale of assets or

services rendered or reimbursement of

expenses incurred, which remained overdue

for a period of more than 90 days.

(vii) the lease rental and hire purchase

instalment, which has become overdue for a

period of more than 90 days.

(viii) in respect of loans, advances and other

credit facilities (including bills purchased and

discounted), the balance outstanding under

the credit facilities (including accrued interest)

made available to the same

borrower/beneficiary when any of the above

credit facilities becomes non-performing

asset.

Provided that in the case of lease and hire

purchase transactions, an NBFC shall

classify each such account on the basis of its

record of recovery.

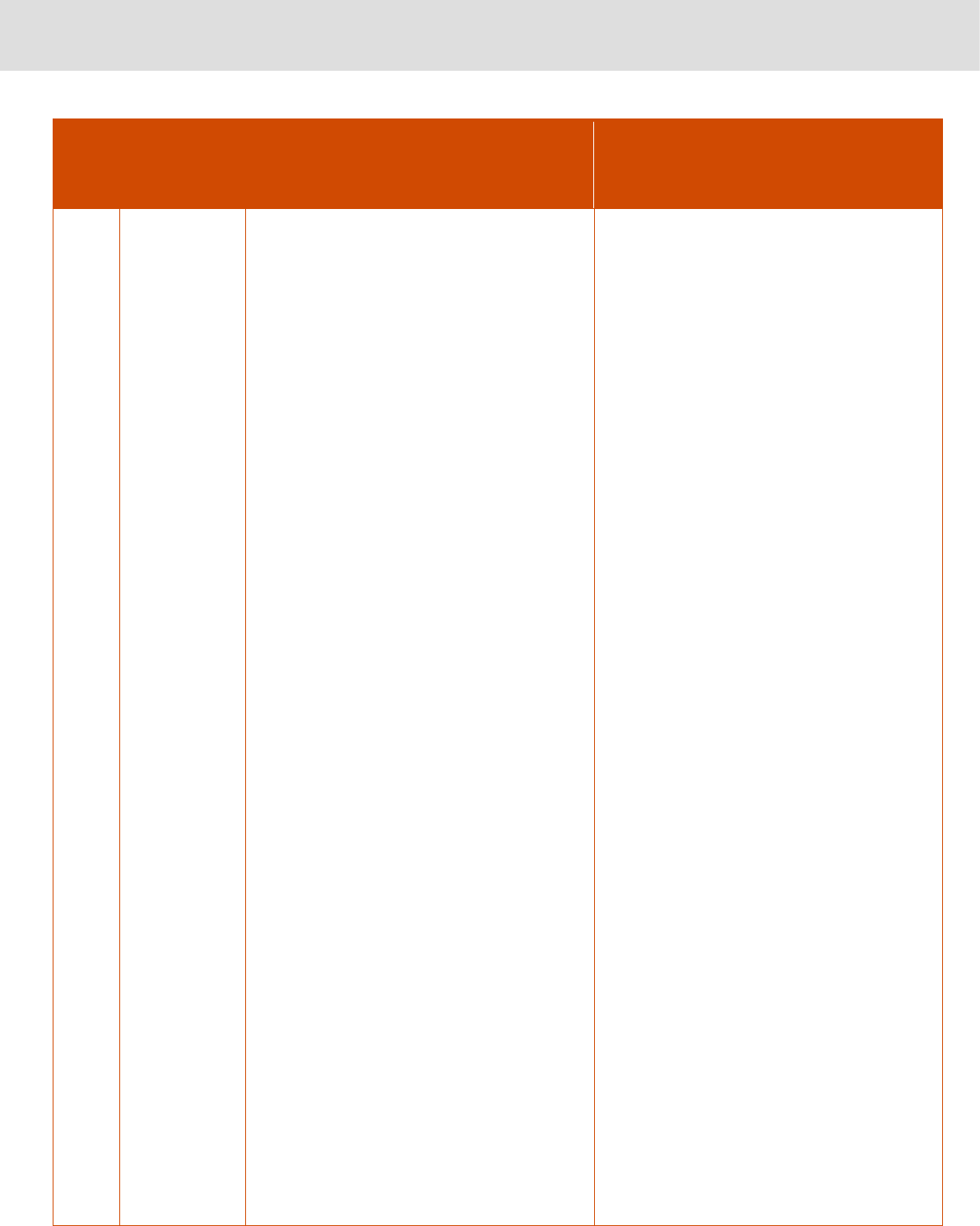

31.

Credit/Investm

ent

concentration

Norms (except

NBFC-UL)

Provisions applicable to NBFC-ND-SI

asset size above 500 crore

(1) No applicable NBFC shall,

Section IV – Regulations applicable for

NBFCs – ML asset size above 1000 crore

Para 91

19 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

(i) lend to

(a) any single borrower exceeding fifteen per

cent of its owned fund; and

(b) any single group of borrowers exceeding

twenty five per cent of its owned fund;

(ii) invest in

(a) the shares of another company exceeding

fifteen per cent of its owned fund; and

(b) the shares of a single group of companies

exceeding twenty five per cent of its owned

fund;

(iii) lend and invest (loans/ investments taken

together) exceeding

(a) twenty five per cent of its owned fund to a

single party; and

(b) forty per cent of its owned fund to a single

group of parties.

Provided that the ceiling on the investment in

shares of another company shall not be

applicable to an applicable NBFC in respect

of investment in the equity capital of an

insurance company up to the extent

specifically permitted, in writing, by the Bank.

Provided further that an applicable NBFC

may exceed the concentration of

credit/investment norms, by 5 per cent for any

single party and by 10 per cent for a single

group of parties, if the additional exposure is

on account of infrastructure loan and/ or

investment.

Provided further that nothing contained in this

paragraph shall apply to

(A) investments of applicable NBFCs in

shares of

i. its subsidiaries;

ii. companies in the same group, to the extent

they have been reduced from Owned Funds

for the calculation of NOF and

(B) the book value of debentures, bonds,

outstanding loans and advances (including

Credit/investment concentration Norms

(except NBFC-UL)

91.1 NBFC(except NBFC-IFC) shall not have

exposure (credit/investment taken together)

exceeding

(a) twenty-five percent of its Tier 1 capital to a

single party; and

(b) forty percent of its Tier 1 capital to a single

group of parties,

Provided that an NBFC may exceed the

exposure norm specified above, by 5 percent

for any single party and by 10 percent for a

single group of parties, if the additional

exposure is on account of infrastructure loan

and/or investment.

91.2 NBFC-IFC shall not have exposure

(credit/investment taken together) exceeding

(a) thirty percent of its Tier 1 capital to a

single party; and

(b) fifty percent of its Tier 1 capital to a single

group of parties.

91.3 The ceiling on the investment in shares

of another company shall not be applicable to

an NBFC in respect of investment in the

equity capital of an insurance company up to

the extent specifically permitted, in writing, by

the Reserve Bank.

91.4 Exposure norms shall not apply to any

NBFC not accessing public funds in India,

either directly or indirectly and not issuing

guarantees.

91.5 Exposure norms shall not apply to

(i) investments of NBFC in shares of

(a) its subsidiaries;

(b) companies in the same group, to the

extent they have been reduced from Owned

Funds for the calculation of NOF and

(ii) the book value of debentures, bonds,

outstanding loans and advances (including

20 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

hire-purchase and lease finance) made to,

and deposits with,-

i. subsidiaries of the applicable NBFC; and

ii. companies in the same group, to the extent

they have been reduced from Owned Funds

for the calculation of NOF.

Provided that Infrastructure Finance

Companies may exceed the concentration of

credit norms

(A) in lending to:

i. any single borrower, by ten per cent of its

owned fund; and

ii. any single group of borrowers, by fifteen

per cent of its owned fund;

(B) in lending to and investing in, (loans/

investments taken together)

i. a single party, by five percent of its owned

fund; and

ii. a single group of parties, by ten percent of

its owned fund.

Provided further that the concentration of

credit/ investment norms shall not apply to

any applicable NBFC not accessing public

funds in India, either directly or indirectly and

not issuing guarantees.

(2) Every applicable NBFC (other than NBFC-

D) shall formulate a policy in respect of

exposures to a single party / a single group of

parties.

(3) An applicable NBFC which is held by an

NOFHC shall not

(i) have any exposure (credit and investments

including investments in the equity/ debt

capital instruments) to the Promoters/

Promoter Group entities or individuals

associated with the Promoter Group or the

NOFHC;

hire purchase and lease finance) made to,

and deposits with -

(a) subsidiaries of the NBFC; and

(b) companies in the same group, to the

extent they have been reduced from Owned

Funds for the calculation of NOF.

91.6 NBFC shall formulate a policy in respect

of exposures to a single party/a single group

of parties.

91.7 Government NBFCs set up to serve

specific sectors may approach the Reserve

Bank for exemptions, if any.

Notes:

1. For determining the limits, off-balance

sheet exposures shall be converted into

credit risk by applying the conversion factors,

as explained in paragraph 85 of these

Directions.

2. These ceilings shall be applicable to the

exposure by an NBFC to

companies/firms/entities in its own group as

well as to the borrowers/investee entity’s

group.

3. (i) In case of factoring on "with-recourse"

basis, the exposure shall be reckoned on the

assignor.

(ii) In case of factoring on "without-recourse"

basis, the exposure shall be reckoned on the

debtor, irrespective of credit risk cover/

protection provided, except in cases of

international factoring where the entire credit

risk has been assumed by the import factor.

21 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

(ii) make investment in the equity/ debt capital

instruments in any of the financial entities

under the NOFHC;

(iii) invest in equity instruments of other

NOFHCs.

Explanation: For the purposes of this

paragraph, the expression, 'Promoter' and

'Promoter Group' shall have the meanings

assigned to those expressions in the

"Guidelines for Licensing of New Banks in the

Private Sector" issued by the Bank – Annex

VI.

Notes:

1. For determining the limits, off-balance

sheet exposures shall be converted into

credit risk by applying the conversion factors

as explained in paragraph ‘Explanation II’ of

Chapter IV of these Directions.

2. The investments in debentures for the

purposes specified in this paragraph shall be

treated as credit and not investment.

3. These ceilings shall be applicable to the

credit/ investment by an applicable NBFC to

companies/firms in its own group as well as

to the borrowers/ investee company’s group.

4. a. In case of factoring on "with-recourse"

basis, the exposure shall be reckoned on the

assignor.

b. In case of factoring on "without-recourse"

basis, the exposure shall be reckoned on the

debtor, irrespective of credit risk cover/

protection provided, except in cases of

international factoring where the entire credit

risk has been assumed by the import factor.

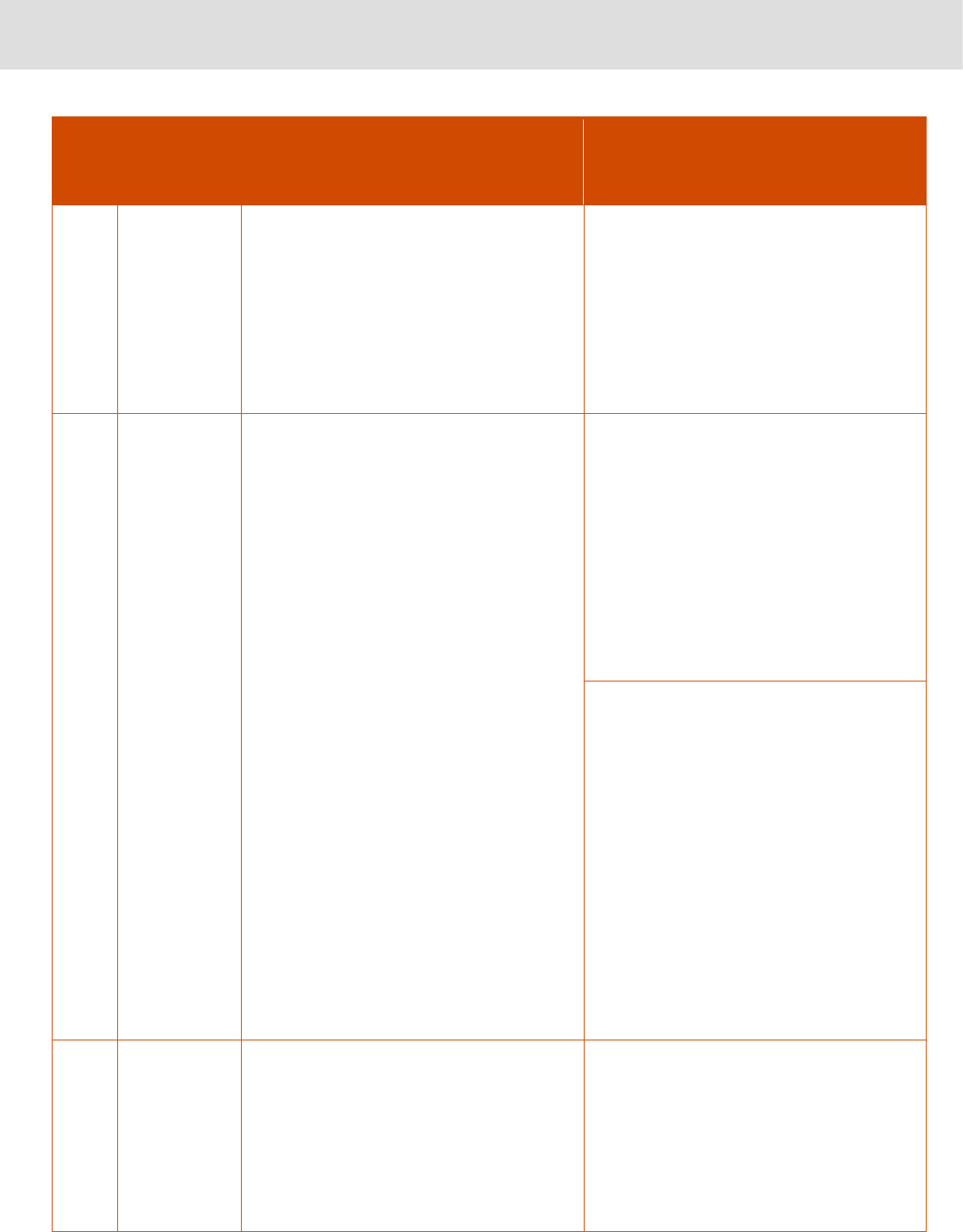

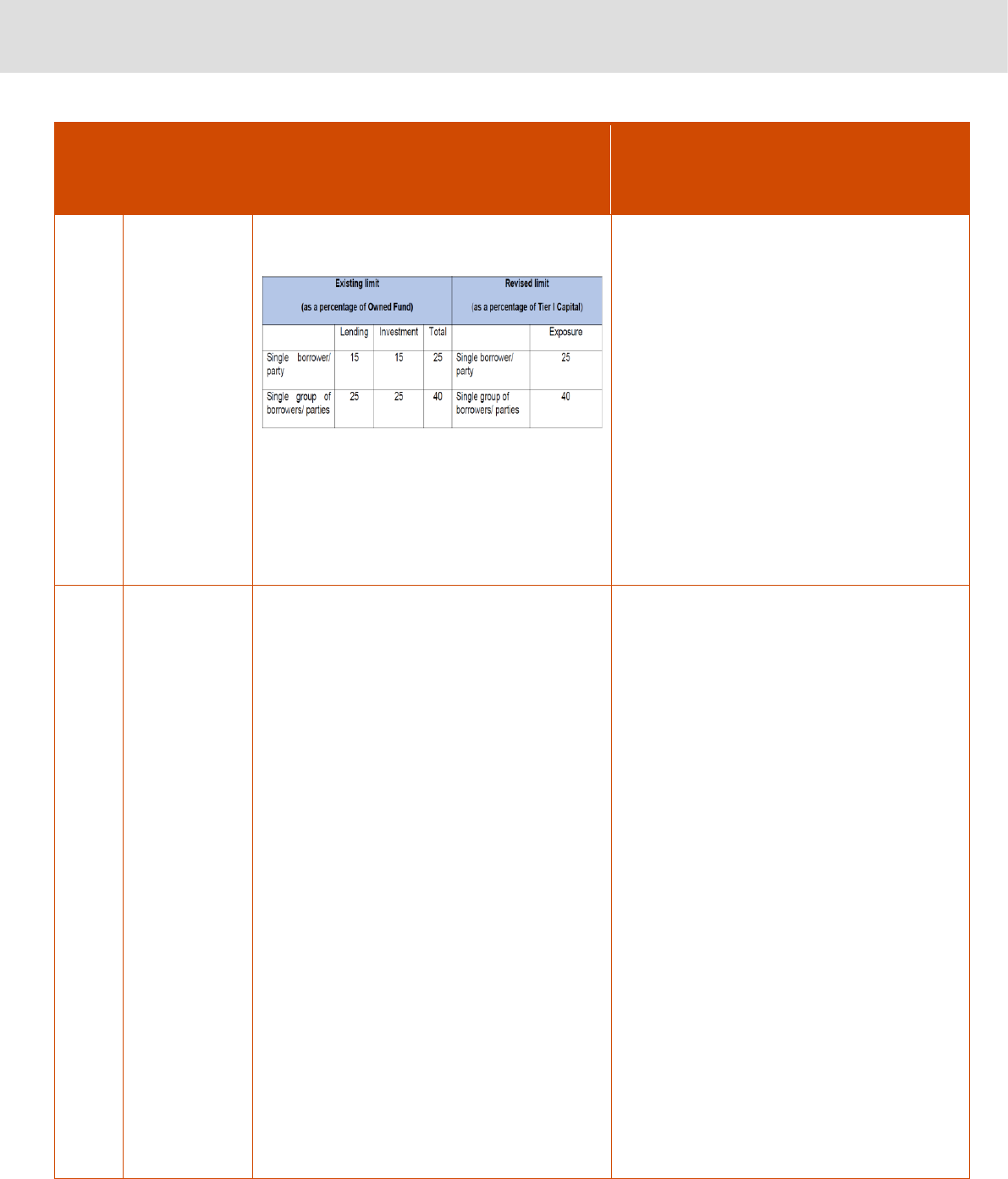

SBR Framework

Concentration of credit/ investment - The

extant credit concentration limits prescribed

for NBFCs separately for lending and

investments shall be merged into a single

exposure limit of 25% for single borrower/

party and 40% for single group of borrowers/

parties. Further, the concentration limits shall

be determined with reference to the NBFC’s

Tier 1 capital instead of their Owned Fund.

22 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

The revised norms are indicated in the table

below:

NBFC-UL shall follow these norms till Large

Exposure Framework is put in place for them.

Extant instructions on concentration norms

for different categories of NBFC, other than

the changes indicated above, will continue to

remain applicable.

32.

Nomination

and

Remuneration

Committee

Nomination Committee

All applicable NBFCs shall form a Nomination

Committee to ensure 'fit and proper' status of

proposed/ existing directors.

Explanation I: The Nomination Committee

constituted under this paragraph shall have

the same powers, functions and duties as laid

down in section 178 of the Companies Act,

2013.

Section IV – Regulations applicable for

NBFCs – ML

Para 94.2

Nomination and Remuneration Committee

NBFCs (except Government NBFCs) shall

form a Nomination and Remuneration

Committee (NRC) which shall have the

constitution, powers, functions and duties as

laid down in section 178 of the Companies

Act, 2013.

Explanation I: Government NBFCs shall form

a Nomination Committee to ensure 'fit and

proper' status of proposed/ existing directors.

Nomination Committee so constituted shall

have the same powers, functions and duties

as laid down in section 178 of the Companies

Act, 2013.

Explanation II - If an NBFC is required to

constitute NRC under section 178 of the

Companies Act, 2013, the NRC so

constituted by it shall be treated as the NRC/

Nomination Committee for the purpose of this

paragraph.

23 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

33.

Participation in

Currency

Options

Non-deposit taking applicable NBFCs with

asset size of ₹500 crore and above, are

allowed to participate in the designated

currency options exchanges recognized by

SEBI, as clients, subject to the Bank’s

(Foreign Exchange Department) guidelines in

the matter, only for the purpose of hedging

their underlying forex exposures. Disclosures

shall be made in the balance sheet regarding

transactions undertaken, in accordance with

the guidelines issued by SEBI.

Section IV – Regulations applicable for

NBFCs – ML

Para 101

Non-deposit taking NBFCs are allowed to

participate in the designated currency options

exchanges recognized by SEBI, as clients,

subject to the guidelines of Foreign Exchange

Department of the Reserve Bank, only for the

purpose of hedging their underlying forex

exposures. Disclosures shall be made in the

balance sheet regarding transactions

undertaken, in accordance with the guidelines

issued by SEBI.

34.

Ready

Forward

Contracts in

Corporate

Debt Securities

Non-deposit taking applicable NBFCs with

asset size of ₹500 crore and above are

eligible to participate in repo transactions in

corporate debt securities. They shall comply

with Repurchase Transactions (Repo)

(Reserve Bank) Directions, 2018 as amended

from time to time.

(a) Capital Adequacy

Risk weights for credit risk for assets that are

the collateral for such transactions as well as

risk weights for the counterparty credit risk

shall be as applicable to the issuer/

counterparty under Chapter IV of these

directions.

(b) Classification of balances in the accounts

Classification of balances in the various

accounts viz. repo account, reverse repo

account etc. shall be done in the relevant

schedules similar to that of banks.

In all other matters related to such repo

transactions, non-deposit taking applicable

NBFCs with asset size of ₹500 crore and

above, shall follow the Directions and

accounting guidelines issued by Internal Debt

Management Department, of the Bank.

Section IV – Regulations applicable for

NBFCs – ML

Para 103

Non-deposit taking NBFCs are eligible to

participate in repo transactions in corporate

debt securities. They shall comply with

‘Repurchase Transactions (Repo) (Reserve

Bank) Directions, 2018’ dated July 24, 2018,

as amended from time to time and also

adhere to the following instructions.

(i) Capital Adequacy

Risk weights for credit risk for assets that are

the collateral for such transactions as well as

risk weights for the counterparty credit risk

shall be as applicable to the issuer/

counterparty under paragraphs 84 and 85 of

these Directions.

(ii) Classification of balances in the accounts

Classification of balances in the various

accounts viz. repo account, reverse repo

account etc. shall be done in the relevant

schedules similar to that of banks.

103.2 In all other matters related to such repo

transactions, non-deposit taking NBFCs, shall

follow the directions and accounting

guidelines issued by Financial Markets

Regulation Department of the Reserve Bank.

24 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

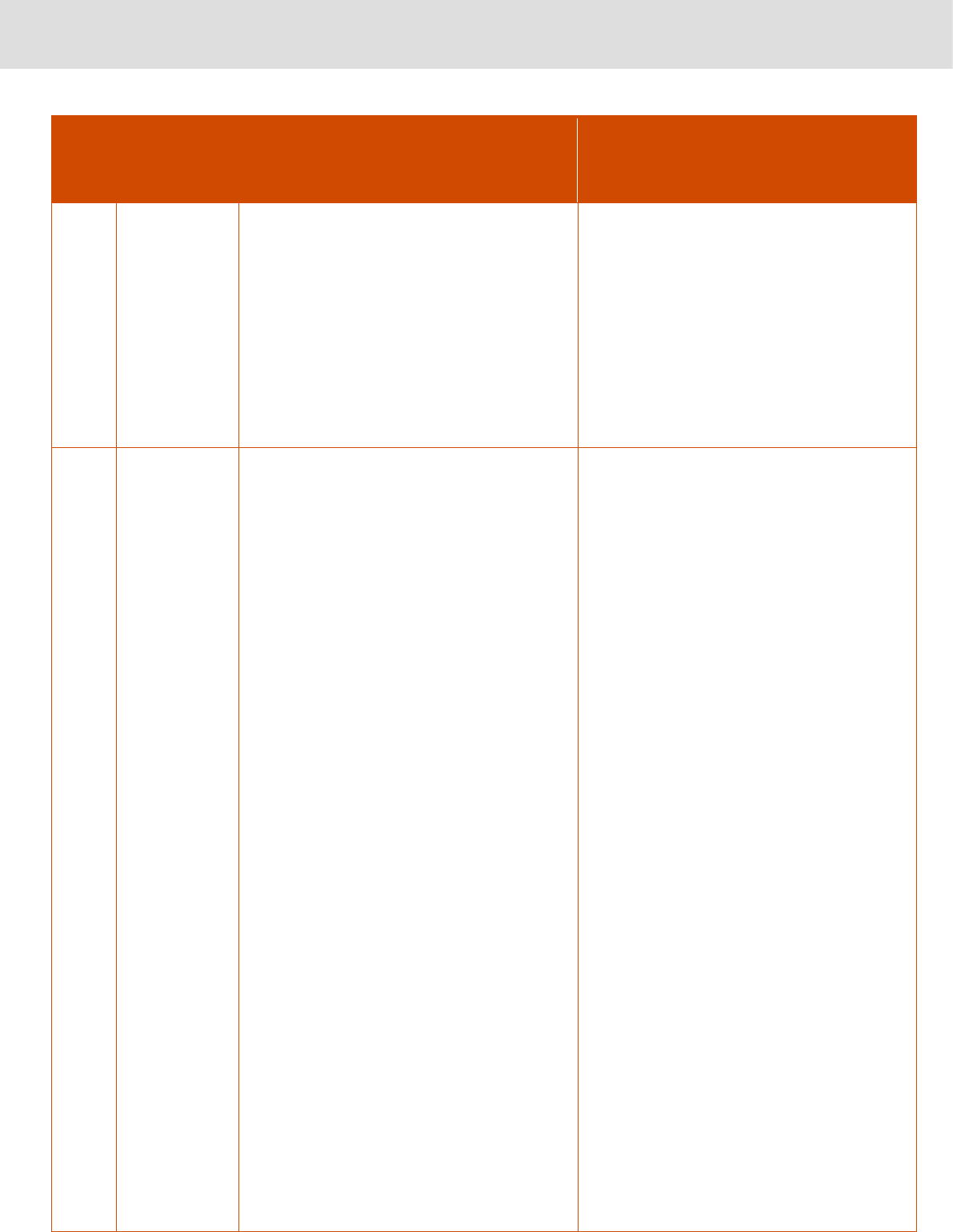

35.

Capital

Requirement

NBFC-MFIs shall maintain a capital adequacy

ratio consisting of Tier I and Tier II Capital

which shall not be less than 15 percent of its

aggregate risk weighted assets on-balance

sheet and of risk adjusted value of off-

balance sheet items. The total of Tier II

Capital at any point of time, shall not exceed

100 percent of Tier I Capital.

Note:

Explanations:……………………………………

Section VI – Specific Directions applicable

for Non-Banking Financial Company –

Micro Finance Institutions (NBFC-MFIs)

and Microfinance Loans of other NBFCs

Para 116

NBFC-MFIs shall maintain a capital adequacy

ratio consisting of Tier 1 and Tier 2 capital

which shall not be less than 15 percent of its

aggregate risk weighted assets of on-balance

sheet and of risk adjusted value of off-

balance sheet items. The total of Tier 2

capital at any point of time, shall not exceed

100 percent of Tier 1 capital. The treatment to

on-balance and off-balance sheet assets for

capital adequacy shall be as provided in

paragraph 84 and 85 of the Directions

respectively. NBFC-MFIs shall also adhere to

provisions in paragraph 86 of the Directions

on treatment of deferred tax assets and

deferred tax liabilities for computation of

capital.

116.1.2 For loans guaranteed under any

existing or future schemes launched by

CGTMSE, CRGFTLIH and NCGTC, NBFC-

MFIs shall assign risk weight as per the

instructions specified in Note (4) of paragraph

84 of Chapter IX of these Directions.

36.

Asset

Classification

NSI Master Directions:

In addition to the prudential norms contained

in Chapter IV of these Directions, for an

NBFC-Factor, a receivable acquired under

factoring which is not paid within six months

of due date as applicable, shall be treated as

NPA irrespective of when the receivable was

acquired by the factor or whether the

factoring was carried out on "with recourse"

basis or "without-recourse" basis. The entity

on which the exposure was booked shall be

shown as NPA and provisioning made

accordingly.

SI Master Directions:

In addition to the prudential norms contained

in Chapter V of these Directions, for an

NBFC-Factor or an NBFC-ICC, a receivable

acquired under factoring which is not paid

within three months of due date as

Section VII – Specific Directions

applicable for NBFC-Factors and NBFC-

ICCs Registered under the Factoring

Regulation Act, 2011

Para 125

125.1 NBFCs-Factors with asset size of less

than ₹500 crore

In addition to the Asset Classification norms

contained in paragraph 14 of the Directions,

for NBFC-Factors with asset size of less than

₹500 crore, a receivable acquired under

factoring which has remained overdue for

more than 180 days of due date as

applicable, shall be treated as NPA

irrespective of when the receivable was

acquired by the NBFC Factor or whether the

factoring was carried out on "with recourse"

basis or "without recourse" basis. Further,

glide path for recognition of NPA as

25 PwC

Regulatory Insights

Sr.No.

Particulars

Previous Master Directions and other

Circulars

1

Master Direction - RBI (Non-Banking

Financial Company – Scale Based

Regulation) Directions, 2023

applicable, shall be treated as nonperforming

asset (NPA) irrespective of when the

receivable was acquired by the factor or

whether the factoring was carried out on "with

recourse" basis or "without recourse" basis.

The entity on which the exposure was booked

shall be shown as NPA and provisioning

made accordingly.

prescribed in paragraph 14.2 of the Directions

shall also be applicable to such NBFC-

Factors. The entity on which the exposure

was booked shall be shown as NPA and

provisioning made accordingly.

125.2 NBFC-Factors with asset size of ₹500

crore and above and NBFC-ICCs granted

CoR under the Factoring Regulation Act,

2011

In addition to the Asset Classification norms

contained in paragraph 87 of the Directions,

for NBFC-Factors with asset of size of ₹500

crore and above or an NBFC-ICC which have

been granted CoR under the Factoring

Regulation Act, 2011, a receivable acquired

under factoring which has remained overdue

for more than 90 days of due date as

applicable, shall be treated as NPA

irrespective of when the receivable was

acquired by the NBFC Factor/ concerned

NBFC-ICC or whether the factoring was

carried out on "with recourse" basis or

"without-recourse" basis. The entity on which

the exposure was booked shall be shown as

NPA and provisioning made accordingly.

37.

Annex IV

Early

Recognition of

Financial

Distress,

Prompt Steps

for Resolution

and Fair

Recovery for

Lenders:

Framework for

Revitalizing

stressed

Assets in the

Economy

Provisions applicable to NBFC-ND-NSI

asset size below 500 crore

The Reserve Bank of India has set up a

Central Repository of Information on Large

Credits (CRILC) to collect, store, and

disseminate credit data to lenders as advised

by the Bank in its Circular No.

DBS.No.OSMOS. 9862/33.01.018/2013-14

dated February 13, 2014 issued by the

Department of Banking Supervision. All

NBFCs, (Notified NBFCs, for short) shall be

required to report the relevant credit

information on a quarterly basis in the

enclosed formats given in Annex I to CRILC

once the XBRL reporting mechanism is

established. Till then they shall forward the

information to PCGM, Department of Banking

Supervision, Reserve Bank of India, World

Trade Centre, Mumbai - 400 005 in hard

copy. The data includes credit information on

all the borrowers having aggregate fund-

based and non-fund based exposure of ₹ 5

crore and above with them and the SMA

status of the borrower. The

Section II – Regulations applicable for

NBFCs – BL (asset size upto 1000 crore)

Para 1.1.2.

The Reserve Bank has set up a Central

Repository of Information on Large Credits

(CRILC) to collect, store, and disseminate

credit data to lenders as advised by the

Reserve Bank in its circular ‘Central

Repository of Information on Large Credits

(CRILC) – Revision in Reporting’ dated

February 13, 2014 issued by the Department

of Supervision. All NBFC-Factors, NBFC-D

and non-deposit taking NBFCs of asset size

of ₹500 crore and above (Notified NBFCs),

shall be required to report the relevant credit

information to CRILC. The data includes

credit information on all the borrowers having

aggregate fund-based and non-fund based

exposure of ₹5 crore and above with them

and the SMA status of the borrower.

26 PwC

Regulatory Insights

The takeaways

The MD compiles and consolidates the existing provisions of the Master Directions applicable to the Systemically

Important and Non-Systemically Important NBFCs in one place. Further, the MD brings in the necessary clarity

with respect to the regulatory requirements for different layers of NBFC, specifically for NBFCs with asset size of

more than INR 500 crore falling in the Base Layer.

pwc.in

In this document, “PwC” refers to PricewaterhouseCoopers Private Limited (a limited liability company in India having Corporate Identity

Number or CIN : U74140WB1983PTC036093), which is a member firm of PricewaterhouseCoopers International Limited (PwCIL), each

member firm of which is a separate legal entity.

©2023 PricewaterhouseCoopers Private Limited. All rights reserved.

Regulatory Insights

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 152

countries with over 328,000 people who are committed to delivering quality in assurance, advisory and tax

services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity.

Please see www.pwc.com/structure for further details.

© 2023 PwC. All rights reserved.

Follow us on

Facebook, LinkedIn, Twitter and YouTube.